Summary

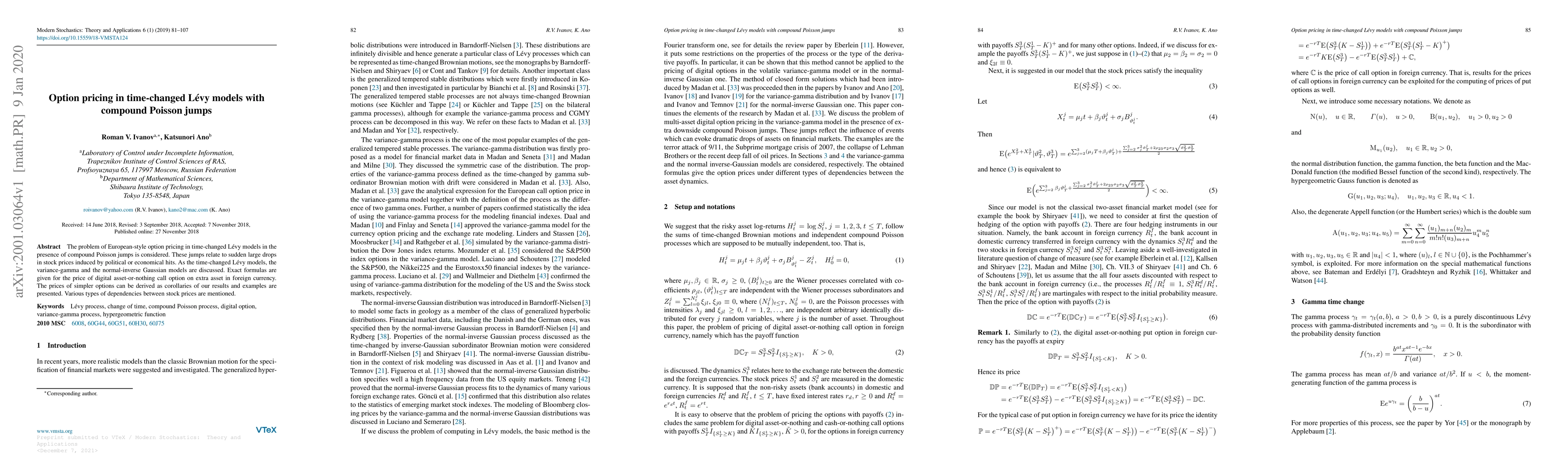

The problem of European-style option pricing in time-changed L\'{e}vy models in the presence of compound Poisson jumps is considered. These jumps relate to sudden large drops in stock prices induced by political or economical hits. As the time-changed L\'{e}vy models, the variance-gamma and the normal-inverse Gaussian models are discussed. Exact formulas are given for the price of digital asset-or-nothing call option on extra asset in foreign currency. The prices of simpler options can be derived as corollaries of our results and examples are presented. Various types of dependencies between stock prices are mentioned.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)