Summary

We provide an European option pricing formula written in the form of an infinite series of Black Scholes type terms under double Levy jumps model, where both the interest rate and underlying price are driven by Levy process. The series solution converges with a radius of convergence, and it is complemented by some numerical experiments to demonstrate its speed of convergence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

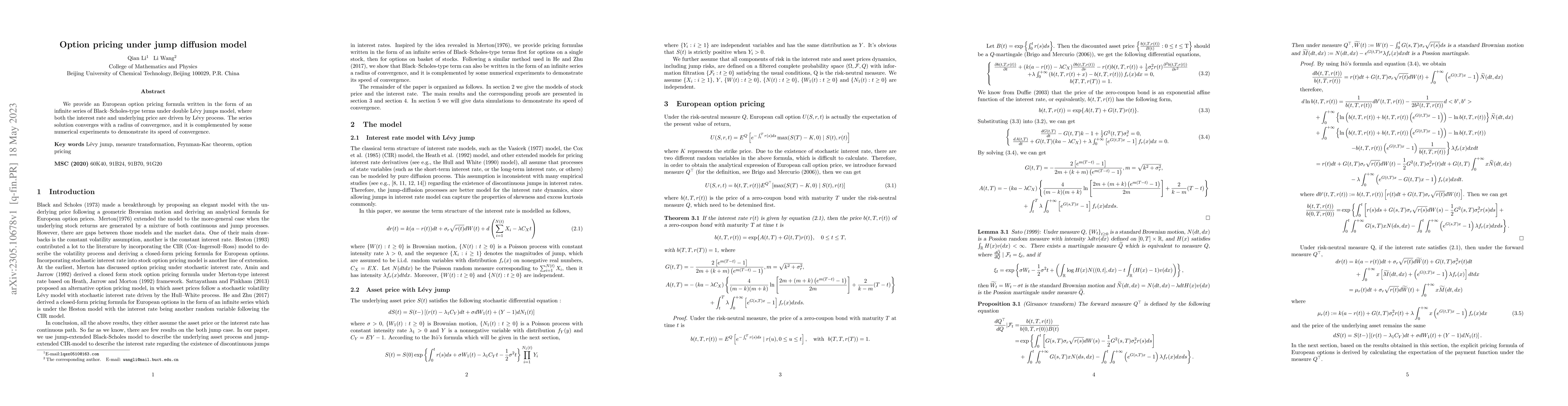

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)