Authors

Summary

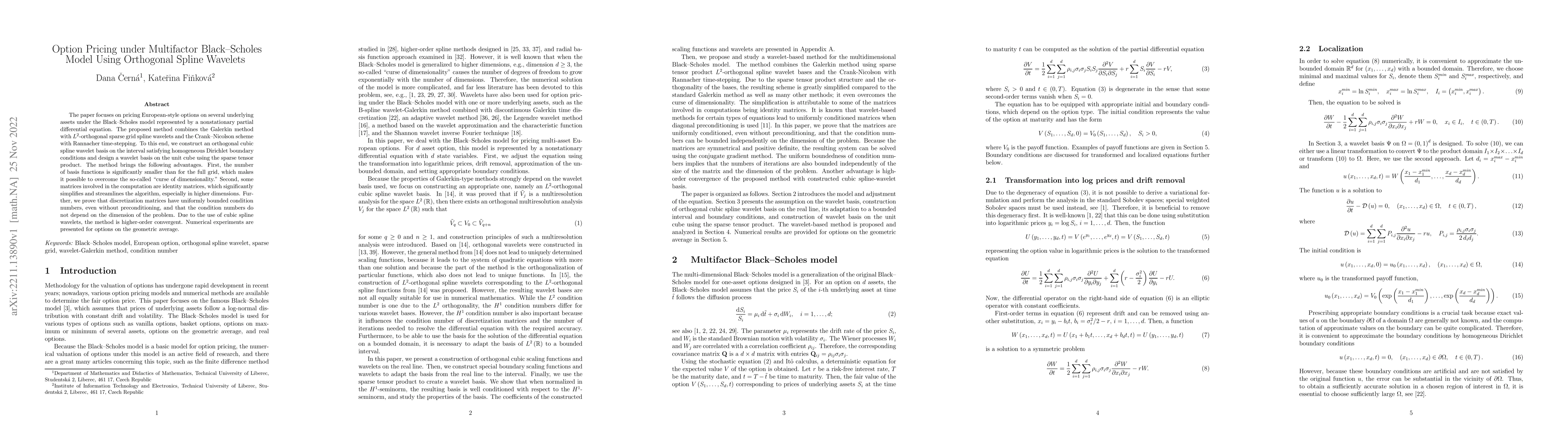

The paper focuses on pricing European-style options on several underlying assets under the Black-Scholes model represented by a nonstationary partial differential equation. The proposed method combines the Galerkin method with $L^2$-orthogonal sparse grid spline wavelets and the Crank-Nicolson scheme with Rannacher time-stepping. To this end, we construct an orthogonal cubic spline wavelet basis on the interval satisfying homogeneous Dirichlet boundary conditions and design a wavelet basis on the unit cube using the sparse tensor product. The method brings the following advantages. First, the number of basis functions is significantly smaller than for the full grid, which makes it possible to overcome the so-called curse of dimensionality. Second, some matrices involved in the computation are identity matrices, which significantly simplifies and streamlines the algorithm, especially in higher dimensions. Further, we prove that discretization matrices have uniformly bounded condition numbers, even without preconditioning, and that the condition numbers do not depend on the dimension of the problem. Due to the use of cubic spline wavelets, the method is higher-order convergent. Numerical experiments are presented for options on the geometric average.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)