Summary

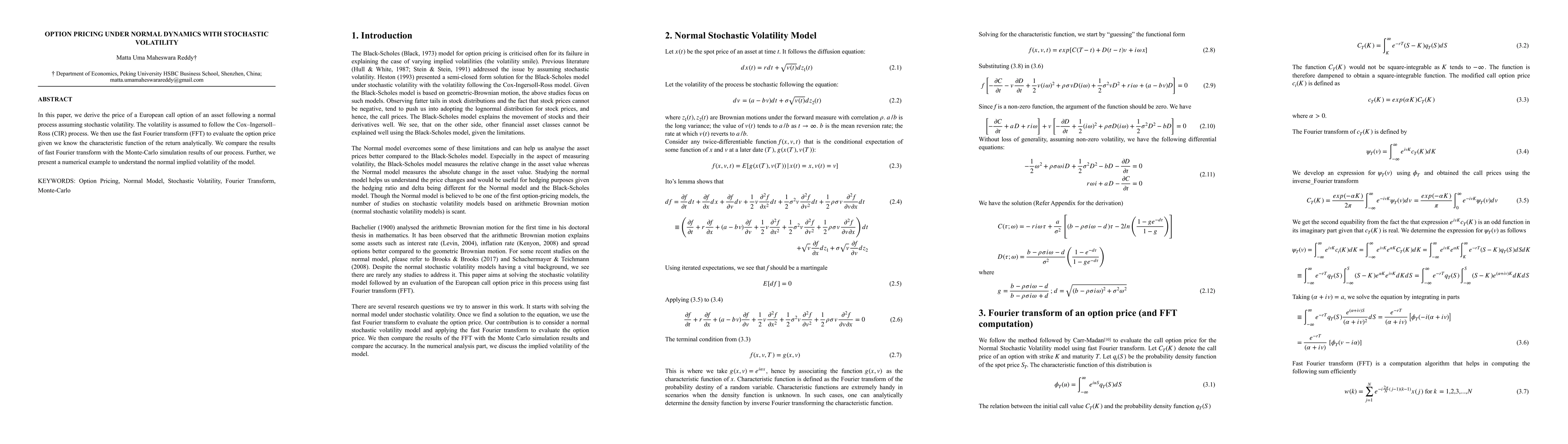

In this paper, we derive the price of a European call option of an asset following a normal process assuming stochastic volatility. The volatility is assumed to follow the Cox Ingersoll Ross (CIR) process. We then use the fast Fourier transform (FFT) to evaluate the option price given we know the characteristic function of the return analytically. We compare the results of fast Fourier transform with the Monte Carlo simulation results of our process. Further, we present a numerical example to understand the normal implied volatility of the model.

AI Key Findings

Generated Sep 06, 2025

Methodology

A solution for a European call option following the arithmetic Brownian motion under stochastic volatility is derived using Fourier transformation.

Key Results

- The output of FFT comes very close to the Monte-Carlo simulation results of the system.

- The Normal Stochastic Volatility model can explain extreme changes in the market better than the Black-Scholes implied volatility.

- The solution is valid for European call options with stochastic volatility.

Significance

This research contributes to the understanding of option pricing under stochastic volatility and its potential impact on financial markets.

Technical Contribution

The use of Fourier transformation to solve option pricing problems under stochastic volatility is a novel approach that provides a more accurate solution than existing methods.

Novelty

This research presents a new method for solving option pricing problems under stochastic volatility, which has the potential to improve our understanding of financial markets and make more accurate predictions.

Limitations

- The model assumes a specific form of volatility, which may not accurately represent real-world market conditions.

- The solution is limited to European call options and does not account for other types of options.

Future Work

- Extending the solution to include other types of options and market conditions.

- Developing a more accurate model of volatility that can capture complex market dynamics.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)