Summary

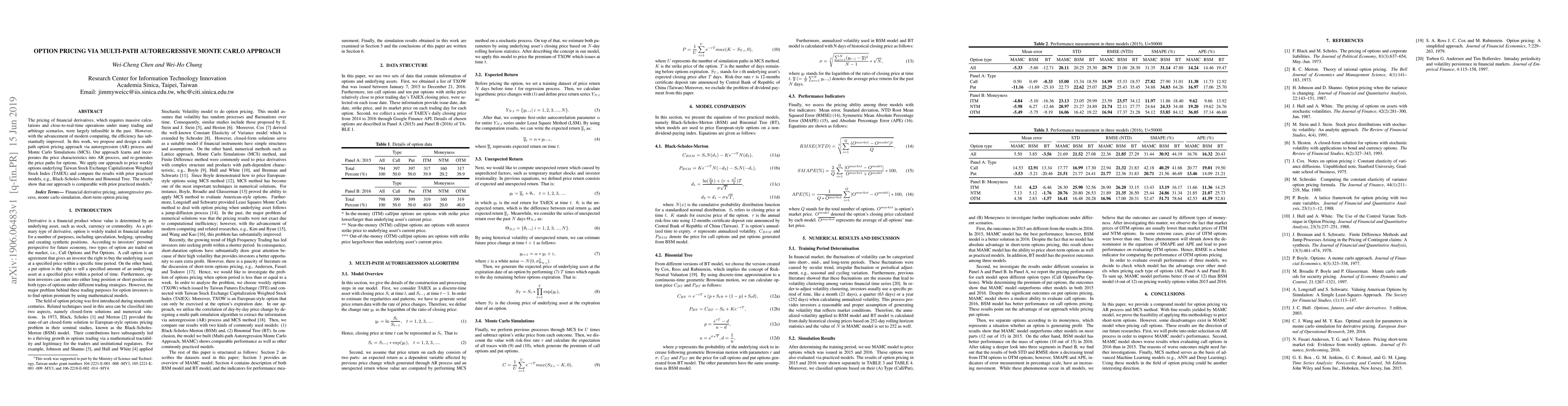

The pricing of financial derivatives, which requires massive calculations and close-to-real-time operations under many trading and arbitrage scenarios, were largely infeasible in the past. However, with the advancement of modern computing, the efficiency has substantially improved. In this work, we propose and design a multi-path option pricing approach via autoregression (AR) process and Monte Carlo Simulations (MCS). Our approach learns and incorporates the price characteristics into AR process, and re-generates the price paths for options. We apply our approach to price weekly options underlying Taiwan Stock Exchange Capitalization Weighted Stock Index (TAIEX) and compare the results with prior practiced models, e.g., Black-Scholes-Merton and Binomial Tree. The results show that our approach is comparable with prior practiced models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDenoised Monte Carlo for option pricing and Greeks estimation

Andrzej Daniluk, Evgeny Lakshtanov, Rafal Muchorski

| Title | Authors | Year | Actions |

|---|

Comments (0)