Authors

Summary

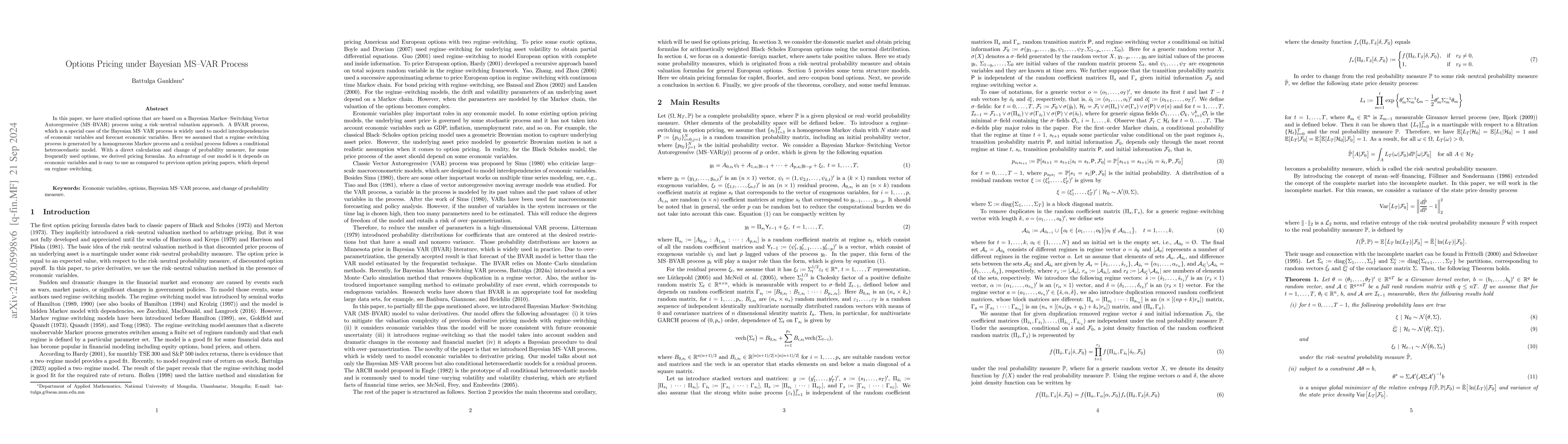

In this paper, we have studied option pricing methods that are based on a Bayesian Markov-Switching Vector Autoregressive (MS-BVAR) process using a risk-neutral valuation approach. A BVAR process, which is a special case of the Bayesian MS-VAR process is widely used to model interdependencies of economic variables and forecast economic variables. Here we assumed that a regime-switching process is generated by a homogeneous Markov process and a residual process follows a conditional heteroscedastic model. With a direct calculation and change of probability measure, for some frequently used options, we derived pricing formulas. An advantage of our model is it depends on economic variables and is easy to use compared to previous option pricing papers, which depend on regime-switching.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)