Summary

We derive new theoretical results on the properties of the adaptive least absolute shrinkage and selection operator (adaptive lasso) for time series regression models. In particular, we investigate the question of how to conduct finite sample inference on the parameters given an adaptive lasso model for some fixed value of the shrinkage parameter. Central in this study is the test of the hypothesis that a given adaptive lasso parameter equals zero, which therefore tests for a false positive. To this end we construct a simple testing procedure and show, theoretically and empirically through extensive Monte Carlo simulations, that the adaptive lasso combines efficient parameter estimation, variable selection, and valid finite sample inference in one step. Moreover, we analytically derive a bias correction factor that is able to significantly improve the empirical coverage of the test on the active variables. Finally, we apply the introduced testing procedure to investigate the relation between the short rate dynamics and the economy, thereby providing a statistical foundation (from a model choice perspective) to the classic Taylor rule monetary policy model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

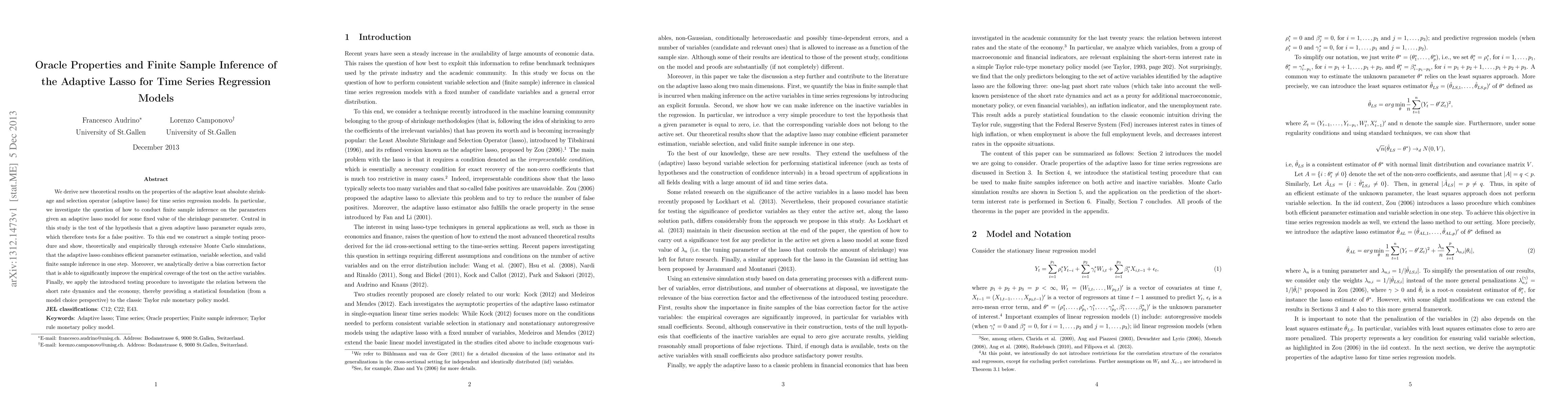

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLasso Inference for High-Dimensional Time Series

Ines Wilms, Stephan Smeekes, Robert Adamek

| Title | Authors | Year | Actions |

|---|

Comments (0)