Summary

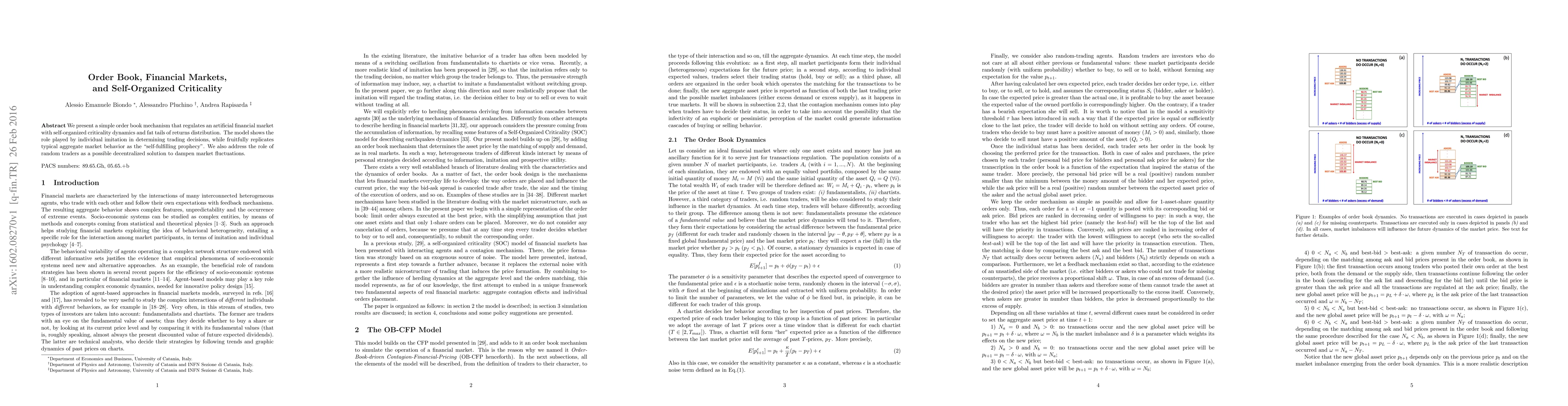

We present a simple order book mechanism that regulates an artificial financial market with self-organized criticality dynamics and fat tails of returns distribution. The model shows the role played by individual imitation in determining trading decisions, while fruitfully replicates typical aggregate market behavior as the "self-fulfilling prophecy". We also address the role of random traders as a possible decentralized solution to dampen market fluctuations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)