Summary

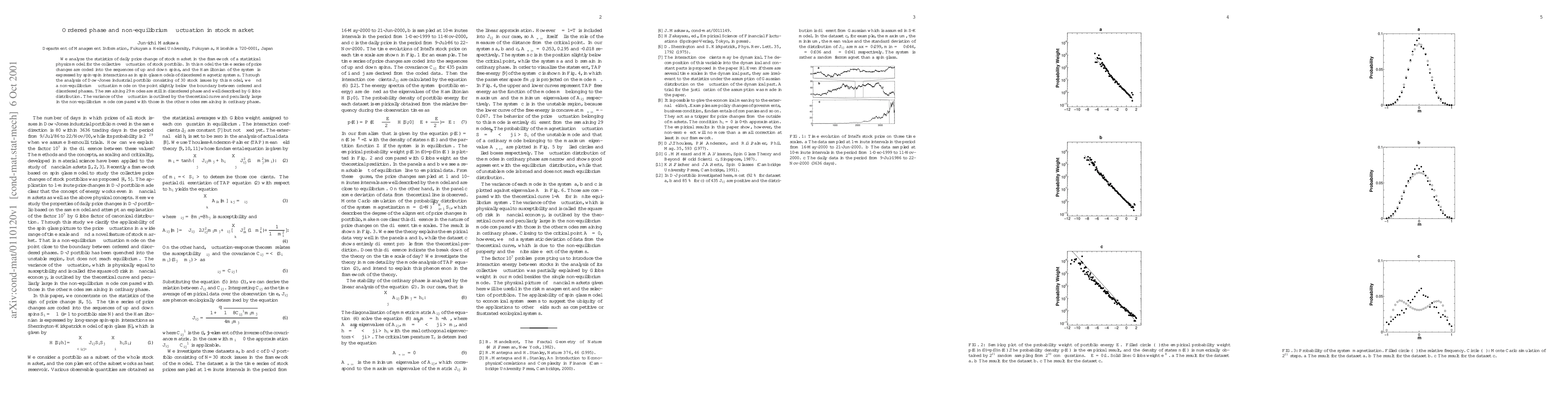

We analyze the statistics of daily price change of stock market in the framework of a statistical physics model for the collective fluctuation of stock portfolio. In this model the time series of price changes are coded into the sequences of up and down spins, and the Hamiltonian of the system is expressed by spin-spin interactions as in spin glass models of disordered magnetic systems. Through the analysis of Dow-Jones industrial portfolio consisting of 30 stock issues by this model, we find a non-equilibrium fluctuation mode on the point slightly below the boundary between ordered and disordered phases. The remaining 29 modes are still in disordered phase and well described by Gibbs distribution. The variance of the fluctuation is outlined by the theoretical curve and peculiarly large in the non-equilibrium mode compared with those in the other modes remaining in ordinary phase.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)