Summary

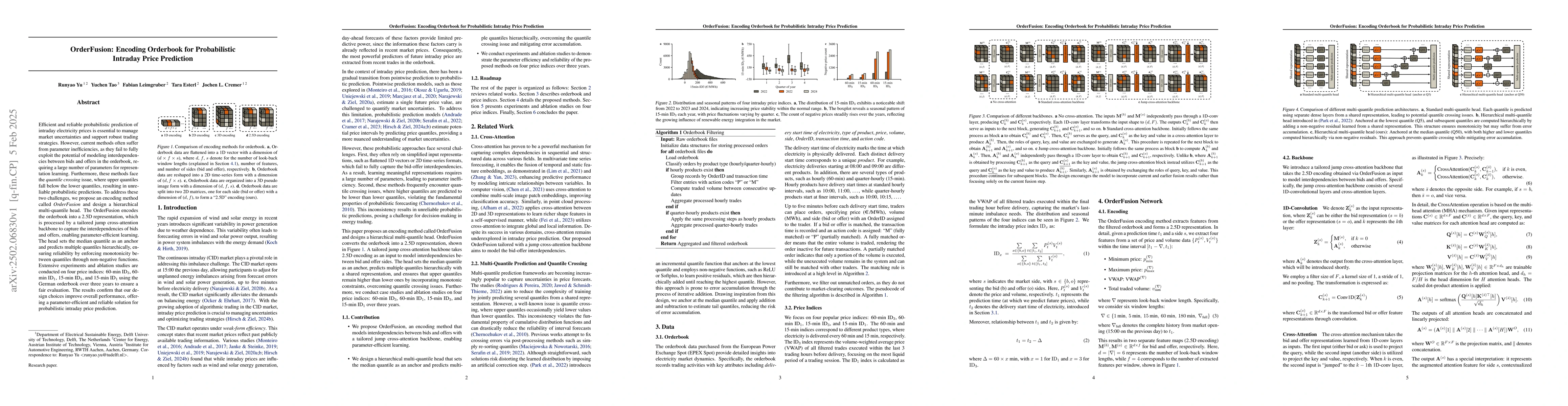

Efficient and reliable probabilistic prediction of intraday electricity prices is essential to manage market uncertainties and support robust trading strategies. However, current methods often suffer from parameter inefficiencies, as they fail to fully exploit the potential of modeling interdependencies between bids and offers in the orderbook, requiring a large number of parameters for representation learning. Furthermore, these methods face the quantile crossing issue, where upper quantiles fall below the lower quantiles, resulting in unreliable probabilistic predictions. To address these two challenges, we propose an encoding method called OrderFusion and design a hierarchical multi-quantile head. The OrderFusion encodes the orderbook into a 2.5D representation, which is processed by a tailored jump cross-attention backbone to capture the interdependencies of bids and offers, enabling parameter-efficient learning. The head sets the median quantile as an anchor and predicts multiple quantiles hierarchically, ensuring reliability by enforcing monotonicity between quantiles through non-negative functions. Extensive experiments and ablation studies are conducted on four price indices: 60-min ID3, 60-min ID1, 15-min ID3, and 15-min ID1 using the German orderbook over three years to ensure a fair evaluation. The results confirm that our design choices improve overall performance, offering a parameter-efficient and reliable solution for probabilistic intraday price prediction.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research proposes OrderFusion, an encoding method for orderbook data that utilizes a hierarchical multi-quantile head and a jump cross-attention backbone to capture interdependencies between bids and offers for efficient and reliable intraday price prediction in electricity markets.

Key Results

- OrderFusion improves parameter efficiency in probabilistic price prediction by modeling orderbook interdependencies.

- The hierarchical multi-quantile head ensures reliability by enforcing monotonicity between quantiles.

- Extensive experiments on German orderbook data over three years demonstrate improved overall performance compared to existing methods.

- The proposed design choices offer a parameter-efficient and reliable solution for intraday price prediction.

- Austrian case study validates the model's effectiveness and robustness across different markets.

Significance

Efficient and reliable intraday price prediction is crucial for managing market uncertainties and supporting robust trading strategies in electricity markets. This research contributes by proposing OrderFusion, which addresses parameter inefficiencies and the quantile crossing issue, providing a parameter-efficient and reliable solution for probabilistic price prediction.

Technical Contribution

OrderFusion introduces a novel 2.5D representation of the orderbook and a jump cross-attention backbone to efficiently capture interdependencies between bids and offers, along with a hierarchical multi-quantile head to ensure reliable probabilistic predictions.

Novelty

OrderFusion distinguishes itself by focusing on parameter-efficient learning through the modeling of orderbook interdependencies, addressing the quantile crossing issue, and providing a unified end-to-end solution for intraday price prediction in electricity markets.

Limitations

- The method relies on commercially available orderbook data, which may limit accessibility and generalizability to other markets without similar datasets.

- The model's performance is dependent on the quality and structure of the orderbook data provided by EPEX Spot.

- While the study validates the approach on German and Austrian data, further research is needed to confirm its applicability to other markets and trading conditions.

Future Work

- Explore the applicability of OrderFusion to other commodity markets and timeframes.

- Investigate the model's performance under varying market conditions and during periods of high volatility.

- Develop strategies to handle missing or incomplete orderbook data to enhance the model's robustness.

- Examine the integration of additional features, such as weather data or external market factors, to further improve prediction accuracy.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProbabilistic intraday electricity price forecasting using generative machine learning

Melanie Schienle, Sebastian Lerch, Rafał Weron et al.

Multivariate Probabilistic Forecasting of Intraday Electricity Prices using Normalizing Flows

Alexander Mitsos, Dirk Witthaut, Manuel Dahmen et al.

IVE: Enhanced Probabilistic Forecasting of Intraday Volume Ratio with Transformers

Hanwool Lee, Heehwan Park

No citations found for this paper.

Comments (0)