Summary

Aggregation sets, which represent model uncertainty due to unknown dependence, are an important object in the study of robust risk aggregation. In this paper, we investigate ordering relations between two aggregation sets for which the sets of marginals are related by two simple operations: distribution mixtures and quantile mixtures. Intuitively, these operations ``homogenize" marginal distributions by making them similar. As a general conclusion from our results, more ``homogeneous" marginals lead to a larger aggregation set, and thus more severe model uncertainty, although the situation for quantile mixtures is much more complicated than that for distribution mixtures. We proceed to study inequalities on the worst-case values of risk measures in risk aggregation, which represent conservative calculation of regulatory capital. Among other results, we obtain an order relation on VaR under quantile mixture for marginal distributions with monotone densities. Numerical results are presented to visualize the theoretical results and further inspire some conjectures. Finally, we provide applications on portfolio diversification under dependence uncertainty and merging p-values in multiple hypothesis testing, and discuss the connection of our results to joint mixability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

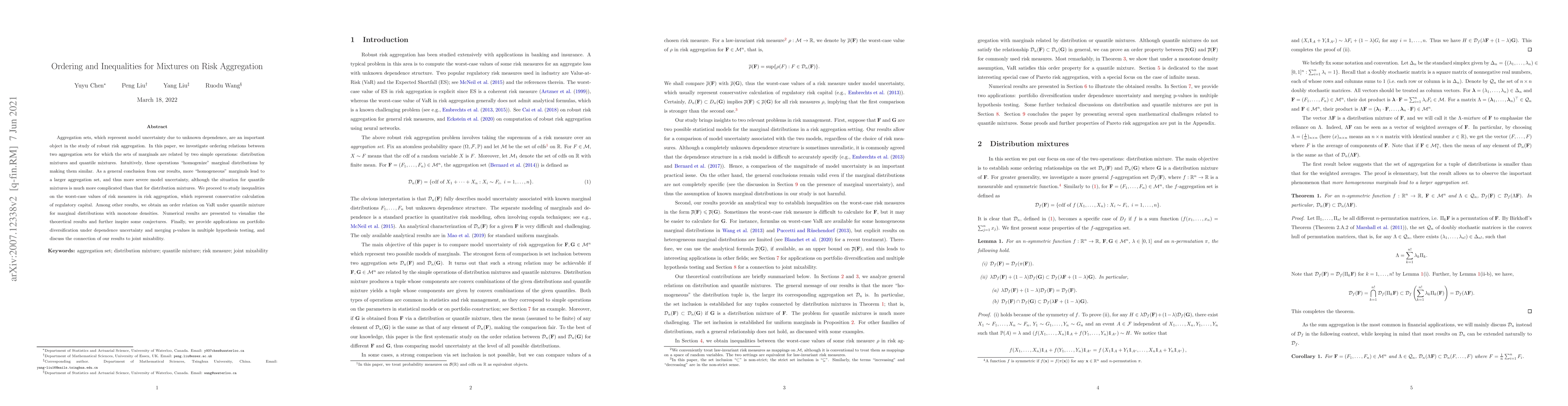

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)