Authors

Summary

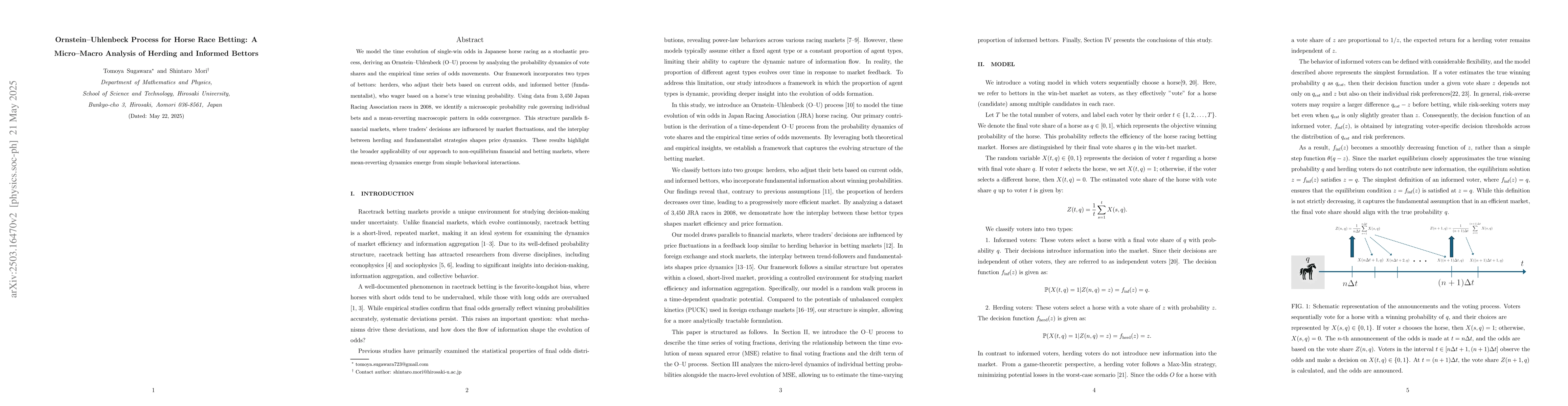

We model the time evolution of single win odds in Japanese horse racing as a stochastic process, deriving an Ornstein--Uhlenbeck process by analyzing the probability dynamics of vote shares and the empirical time series of odds movements. Our framework incorporates two types of bettors: herders, who adjust their bets based on current odds, and fundamentalists, who wager based on a horse's true winning probability. Using data from 3450 Japan Racing Association races in 2008, we identify a microscopic probability rule governing individual bets and a mean-reverting macroscopic pattern in odds convergence. This structure parallels financial markets, where traders' decisions are influenced by market fluctuations, and the interplay between herding and fundamentalist strategies shapes price dynamics. These results highlight the broader applicability of our approach to non-equilibrium financial and betting markets, where mean-reverting dynamics emerge from simple behavioral interactions.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research models the time evolution of single win odds in Japanese horse racing using a stochastic process, deriving an Ornstein-Uhlenbeck process. It analyzes probability dynamics of vote shares and empirical time series of odds movements, incorporating herder and fundamentalist bettor types.

Key Results

- Identified a microscopic probability rule governing individual bets.

- Revealed a mean-reverting macroscopic pattern in odds convergence.

- Parallel drawn to financial markets, where traders' decisions are influenced by market fluctuations.

Significance

This research highlights broader applicability of the approach to non-equilibrium financial and betting markets, demonstrating how mean-reverting dynamics emerge from simple behavioral interactions.

Technical Contribution

Development of a framework that combines micro-level individual betting behavior with macro-level odds convergence, modeled via Ornstein-Uhlenbeck process.

Novelty

The paper introduces a novel approach to understanding betting market dynamics by merging microscopic individual behavior with macroscopic market patterns, bridging gaps in existing literature.

Limitations

- The study is specific to Japanese horse racing data from 2008.

- Generalizability to other racing contexts or different types of betting markets may be limited.

Future Work

- Explore application of the model to other betting or financial markets.

- Investigate the impact of additional factors, such as public information or insider trading, on market dynamics.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)