Summary

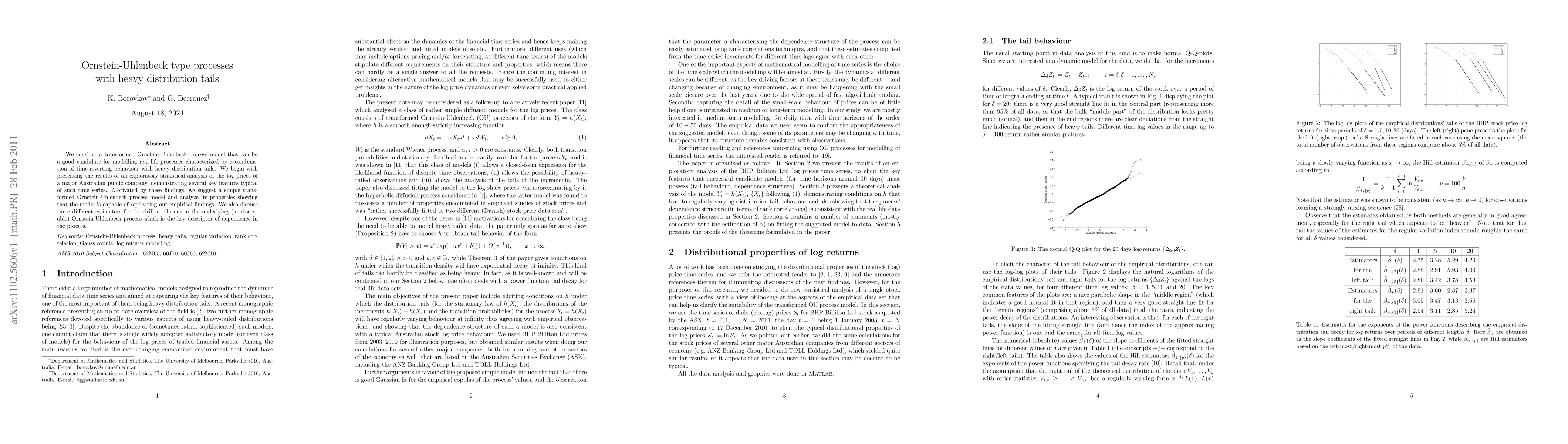

We consider a transformed Ornstein-Uhlenbeck process model that can be a good candidate for modelling real-life processes characterized by a combination of time-reverting behaviour with heavy distribution tails. We begin with presenting the results of an exploratory statistical analysis of the log prices of a major Australian public company, demonstrating several key features typical of such time series. Motivated by these findings, we suggest a simple transformed Ornstein-Uhlenbeck process model and analyze its properties showing that the model is capable of replicating our empirical findings. We also discuss three different estimators for the drift coefficient in the underlying (unobservable) Ornstein-Uhlenbeck process which is the key descriptor of dependence in the process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)