Summary

Parabolic partial differential equations (PDEs) are widely used in the mathematical modeling of natural phenomena and man made complex systems. In particular, parabolic PDEs are a fundamental tool to determine fair prices of financial derivatives in the financial industry. The PDEs appearing in financial engineering applications are often nonlinear and high dimensional since the dimension typically corresponds to the number of considered financial assets. A major issue is that most approximation methods for nonlinear PDEs in the literature suffer under the so-called curse of dimensionality in the sense that the computational effort to compute an approximation with a prescribed accuracy grows exponentially in the dimension of the PDE or in the reciprocal of the prescribed approximation accuracy and nearly all approximation methods have not been shown not to suffer under the curse of dimensionality. Recently, a new class of approximation schemes for semilinear parabolic PDEs, termed full history recursive multilevel Picard (MLP) algorithms, were introduced and it was proven that MLP algorithms do overcome the curse of dimensionality for semilinear heat equations. In this paper we extend those findings to a more general class of semilinear PDEs including as special cases semilinear Black-Scholes equations used for the pricing of financial derivatives with default risks. More specifically, we introduce an MLP algorithm for the approximation of solutions of semilinear Black-Scholes equations and prove that the computational effort of our method grows at most polynomially both in the dimension and the reciprocal of the prescribed approximation accuracy. This is, to the best of our knowledge, the first result showing that the approximation of solutions of semilinear Black-Scholes equations is a polynomially tractable approximation problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

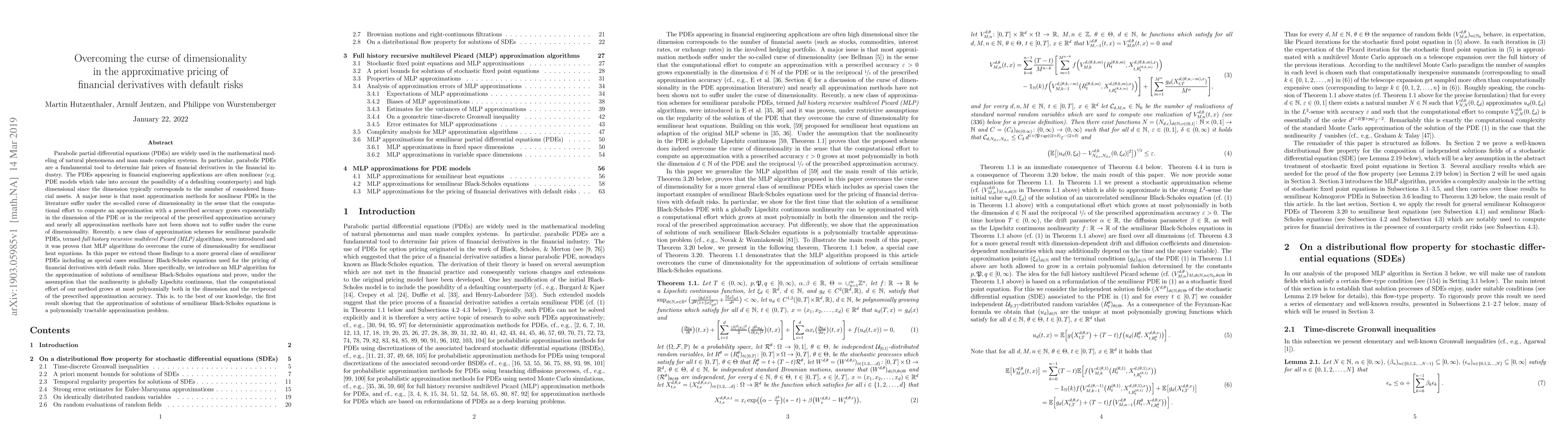

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)