Summary

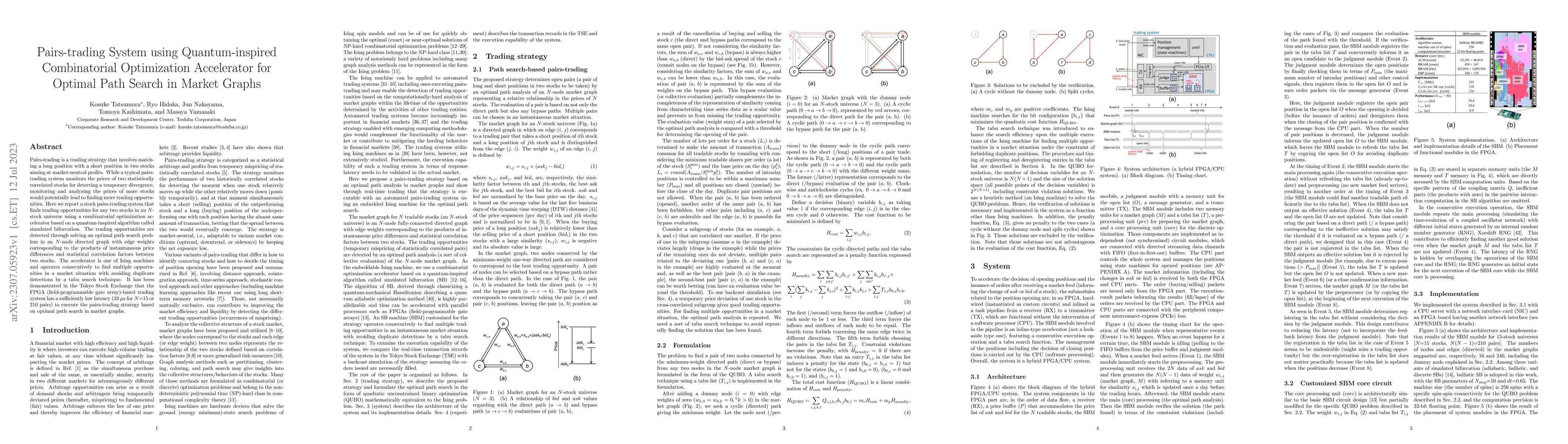

Pairs-trading is a trading strategy that involves matching a long position with a short position in two stocks aiming at market-neutral profits. While a typical pairs-trading system monitors the prices of two statistically correlated stocks for detecting a temporary divergence, monitoring and analyzing the prices of more stocks would potentially lead to finding more trading opportunities. Here we report a stock pairs-trading system that finds trading opportunities for any two stocks in an $N$-stock universe using a combinatorial optimization accelerator based on a quantum-inspired algorithm called simulated bifurcation. The trading opportunities are detected through solving an optimal path search problem in an $N$-node directed graph with edge weights corresponding to the products of instantaneous price differences and statistical correlation factors between two stocks. The accelerator is one of Ising machines and operates consecutively to find multiple opportunities in a market situation with avoiding duplicate detections by a tabu search technique. It has been demonstrated in the Tokyo Stock Exchange that the FPGA (field-programmable gate array)-based trading system has a sufficiently low latency (33 $\mu$s for $N$=15 or 210 pairs) to execute the pairs-trading strategy based on optimal path search in market graphs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLyapunov control-inspired strategies for quantum combinatorial optimization

Alicia B. Magann, Kenneth M. Rudinger, Mohan Sarovar et al.

A quantum-inspired tensor network method for constrained combinatorial optimization problems

Cheng Peng, Chunjing Jia, Tianyi Hao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)