Authors

Summary

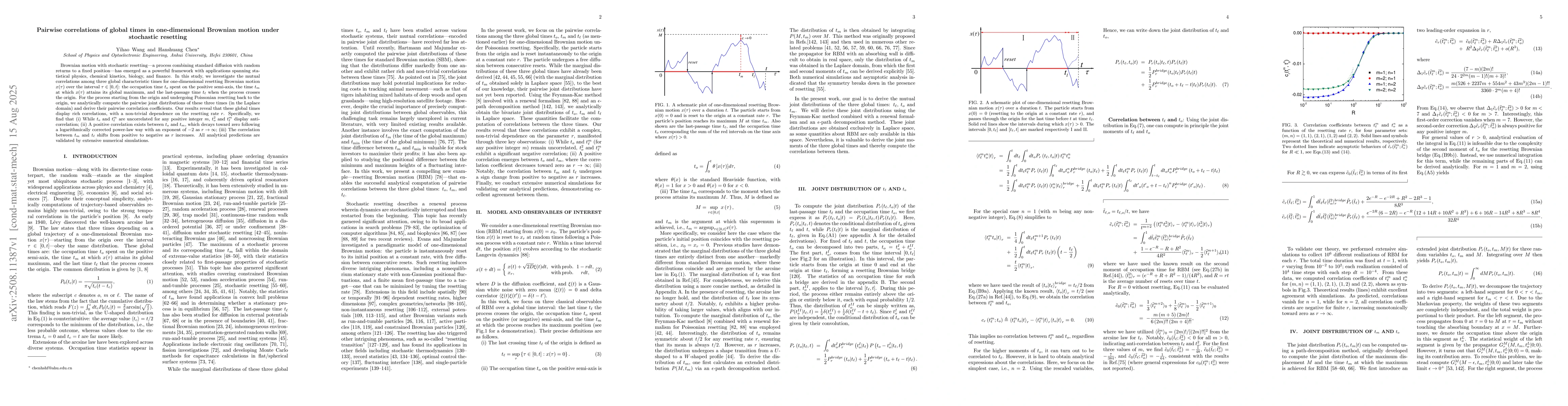

Brownian motion with stochastic resetting-a process combining standard diffusion with random returns to a fixed position-has emerged as a powerful framework with applications spanning statistical physics, chemical kinetics, biology, and finance. In this study, we investigate the mutual correlations among three global characteristic times for one-dimensional resetting Brownian motion $x(\tau)$ over the interval $\tau \in \left[ 0, t\right] $: the occupation time $t_o$ spent on the positive semi-axis, the time $t_m$ at which $x(\tau)$ attains its global maximum, and the last-passage time $t_{\ell}$ when the process crosses the origin. For the process starting from the origin and undergoing Poissonian resetting back to the origin, we analytically compute the pairwise joint distributions of these three times (in the Laplace domain) and derive their pairwise correlation coefficients. Our results reveal that these global times display rich correlations, with a non-trivial dependence on the resetting rate $r$. Specifically, we find that (i) While $t_{o}$ and $t_{\ell}^m$ are uncorrelated for any positive integer $m$, $t_{o}^2$ and $t_{\ell}^m$ display anti-correlation; (ii) A positive correlation exists between $t_{o}$ and $t_{m}$, which decays toward zero following a logarithmically corrected power-law way with an exponent of $-2$ as $r \to \infty$; (iii) The correlation between $t_{m}$ and $t_{\ell}$ shifts from positive to negative as $r$ increases. All analytical predictions are validated by extensive numerical simulations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersErgodic properties of Brownian motion under stochastic resetting

Eli Barkai, Vicenç Méndez, Rosa Flaquer-Galmes

Optimal first-passage times of active Brownian particles under stochastic resetting

Christina Kurzthaler, Yanis Baouche

Active Brownian particle under stochastic orientational resetting

Thomas Franosch, Christina Kurzthaler, Yanis Baouche et al.

Comments (0)