Summary

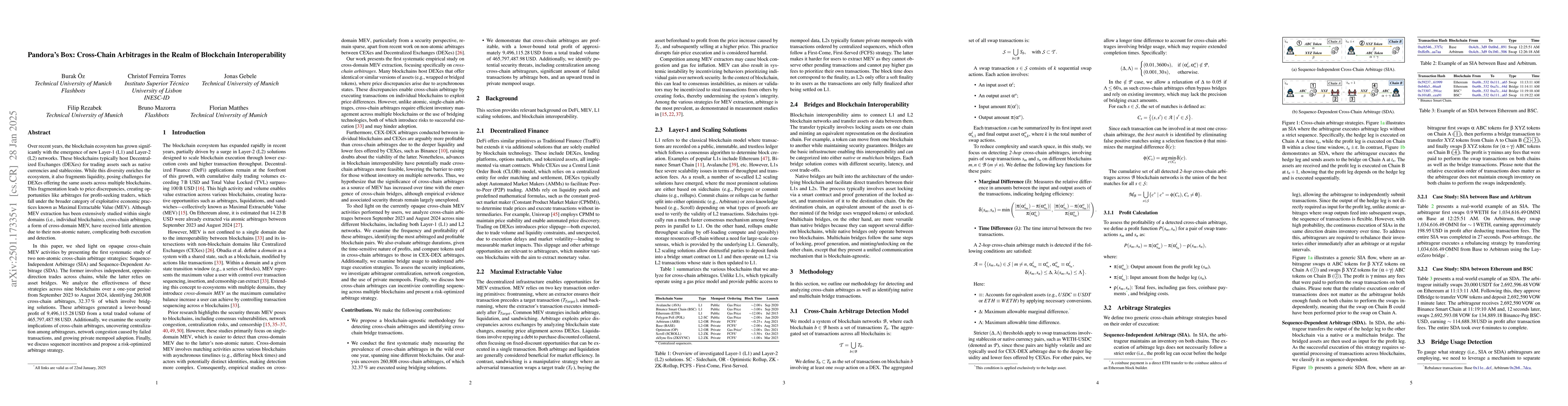

Over recent years, the blockchain ecosystem has grown significantly with the emergence of new Layer-1 (L1) and Layer-2 (L2) networks. These blockchains typically host Decentralized Exchanges (DEXes) for trading assets such as native currencies and stablecoins. While this diversity enriches the ecosystem, it also fragments liquidity, posing challenges for DEXes offering the same assets across multiple blockchains. This fragmentation leads to price discrepancies, creating opportunities like arbitrages for profit-seeking traders, which fall under the broader category of exploitative economic practices known as Maximal Extractable Value (MEV). Although MEV extraction has been extensively studied within single domains (i.e., individual blockchains), cross-chain arbitrages, a form of cross-domain MEV, have received little attention due to their non-atomic nature, complicating both execution and detection. In this paper, we shed light on opaque cross-chain MEV activities by presenting the first systematic study of two non-atomic cross-chain arbitrage strategies: Sequence-Independent Arbitrage (SIA) and Sequence-Dependent Arbitrage (SDA). The former involves independent, opposite-direction trades across chains, while the latter relies on asset bridges. We analyze the effectiveness of these strategies across nine blockchains over a one-year period from September 2023 to August 2024, identifying 260,808 cross-chain arbitrages, 32.37% of which involve bridging solutions. These arbitrages generated a lower-bound profit of 9,496,115.28 USD from a total traded volume of 465,797,487.98 USD. Additionally, we examine the security implications of cross-chain arbitrages, uncovering centralization among arbitrageurs, network congestion caused by failed transactions, and growing private mempool adoption. Finally, we discuss sequencer incentives and propose a risk-optimized arbitrage strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEnhancing Blockchain Cross Chain Interoperability: A Comprehensive Survey

Qi Chen, Wei Liang, Zhihong Deng et al.

MAP the Blockchain World: A Trustless and Scalable Blockchain Interoperability Protocol for Cross-chain Applications

Yang Liu, Jiannong Cao, Ruidong Li et al.

PIEChain -- A Practical Blockchain Interoperability Framework

Anwitaman Datta, Daniël Reijsbergen, Jingchi Zhang et al.

Contextual Pandora's Box

Christos Tzamos, Constantine Caramanis, Orestis Papadigenopoulos et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)