Authors

Summary

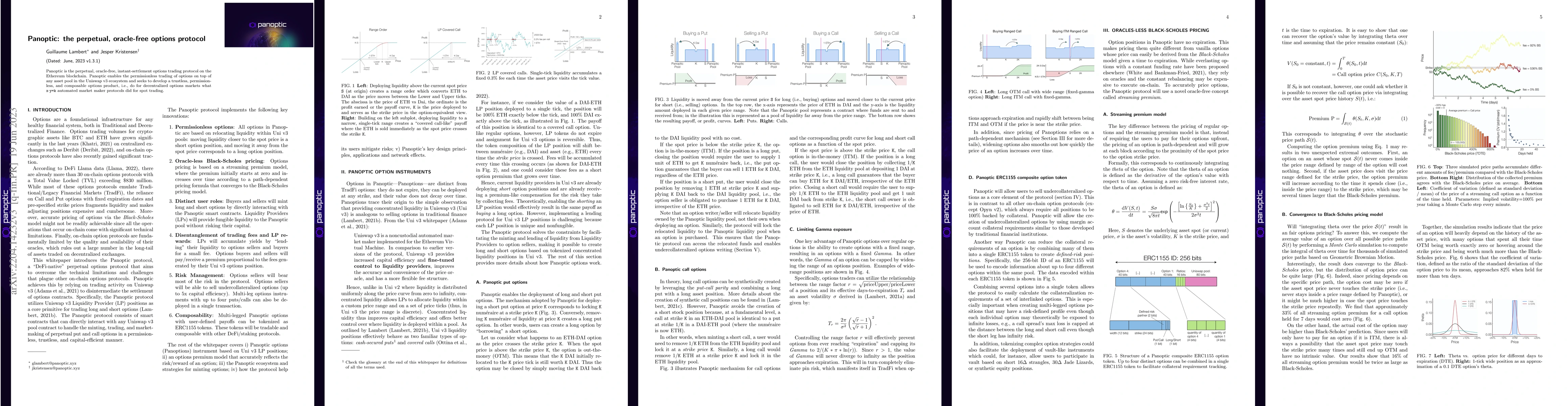

Panoptic is the perpetual, oracle-free, instant-settlement options trading protocol on the Ethereum blockchain. Panoptic enables the permissionless trading of options on top of any asset pool in the Uniswap v3 ecosystem and seeks to develop a trustless, permissionless, and composable options product, i.e., do for decentralized options markets what x*y=k automated market maker protocols did for spot trading.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research introduces Panoptic, a perpetual, oracle-free options trading protocol on Ethereum, utilizing Uniswap v3 for liquidity pools and employing an innovative streaming premium model for pricing options without oracles.

Key Results

- Panoptic enables permissionless trading of options on any asset pool within the Uniswap v3 ecosystem.

- The protocol introduces an oracle-free concept called streaming premium for pricing options, which grows with each block according to the proximity of the spot price to the option strike price.

- Panoptic allows the creation of undercollateralized options, reducing collateral requirements through margin account collateral requirements and combining multiple options into a single ERC1155 token.

- The paper demonstrates that the option pricing converges to the Black-Scholes pricing model on average, although the distribution of option prices can be large, with a significant portion of streaming option premiums potentially being much higher than Black-Scholes predictions.

- Panoptic's framework for cost calculation of options considers the total liquidity amount deployed at a given tick, with fees collected proportional to the amount of liquidity deployed.

Significance

Panoptic's development is significant as it offers a trustless, permissionless, and composable options product for decentralized options markets, potentially revolutionizing the DeFi space by enabling more complex and flexible options trading.

Technical Contribution

Panoptic's technical contributions include the development of an oracle-free, streaming premium pricing model for perpetual options, as well as a method for creating and managing undercollateralized options through ERC1155 composite tokens.

Novelty

Panoptic's novelty lies in its oracle-free, instant-settlement options protocol, which operates within the Uniswap v3 ecosystem, enabling permissionless trading of options with reduced collateral requirements and novel composite token structures.

Limitations

- The protocol's reliance on Uniswap v3 liquidity pools may introduce volatility and impermanent loss risks for liquidity providers.

- The convergence of streaming premium pricing to the Black-Scholes model, while on average, may result in unpredictable and potentially extreme option pricing outcomes.

- The effectiveness and security of the oracle-free pricing model and undercollateralized options remain to be tested in real-world conditions.

Future Work

- Further research could explore ways to mitigate risks associated with undercollateralized options and improve the stability of the streaming premium pricing model.

- Investigating the scalability and efficiency of Panoptic on different blockchain networks beyond Ethereum could expand its potential applications.

- Exploring integration with other DeFi protocols and structured products could enhance Panoptic's utility and attractiveness to a broader user base.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)