Summary

Financial reinforcement learning has attracted lots of attention recently. From 2023 to 2025, we have organized three FinRL Contests featuring different financial tasks. Large language models have a strong capability to process financial documents. By integrating LLM-generated signals into the state, trading agents can take smarter actions based on both structured market data and unstructured financial documents. In this paper, we summarize the parallel market environments for tasks used in FinRL Contests 2023-2025. To address the sampling bottleneck during training, we introduce GPU-optimized parallel market environments to address the sampling bottleneck. In particular, two new tasks incorporate LLM-generated signals and all tasks support massively parallel simulation. Contestants have used these market environments to train robust and powerful trading agents for both stock and cryptocurrency trading tasks.

AI Key Findings

Generated Jun 10, 2025

Methodology

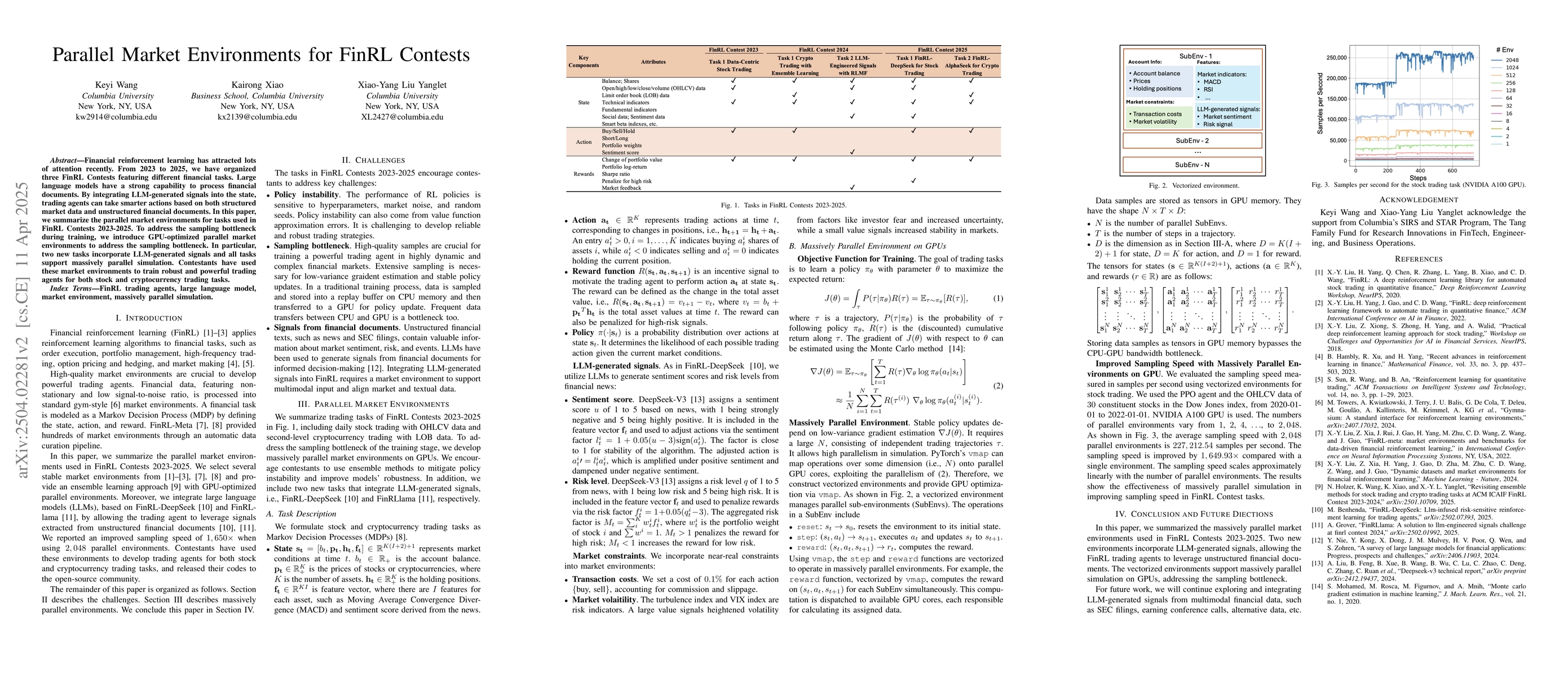

The paper details the FinRL Contests from 2023 to 2025, focusing on financial reinforcement learning tasks. It introduces GPU-optimized parallel market environments to address sampling bottlenecks, supports LLM-generated signals integration, and provides standardized tasks, datasets, and evaluation metrics for reproducibility and comparability.

Key Results

- Three FinRL Contests were organized featuring different financial tasks.

- Massively parallel GPU-optimized market environments improved sampling speed by 1,649.93x compared to a single environment.

- Ensemble trading agents mitigated policy instability and outperformed traditional baselines in stock trading tasks.

- LLM-generated signals from news demonstrated effectiveness in stock trading, with a strategy yielding a 134.05% cumulative return.

- FinRL-DeepSeek for Stock Trading task winners showed superior performance over S&P500 and Nasdaq-100 in cumulative return and Sharpe ratio.

Significance

This research provides a benchmark for data-driven financial reinforcement learning agents, enabling fair comparisons and fostering advancements in the field by offering standardized tasks, datasets, and evaluation metrics.

Technical Contribution

The paper introduces GPU-optimized parallel market environments and methods for integrating LLM-generated signals, significantly enhancing the training efficiency and performance of trading agents.

Novelty

The FinRL Contests provide a novel benchmarking platform for financial reinforcement learning, integrating advanced techniques like massively parallel simulations and LLM-generated signals, which differentiate it from previous research in the field.

Limitations

- The paper does not extensively discuss the limitations of the proposed methodology.

- Specific limitations such as data quality, model assumptions, or generalizability are not detailed.

Future Work

- Exploring integration of LLM-generated signals from multimodal financial data like SEC filings and earnings conference calls.

- Developing FinRL trading agents capable of processing and reasoning over multimodal data in real-time for intelligent trading systems.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinRL-Meta: Market Environments and Benchmarks for Data-Driven Financial Reinforcement Learning

Jian Guo, Ming Zhu, Zhaoran Wang et al.

FinRL-Meta: A Universe of Near-Real Market Environments for Data-Driven Deep Reinforcement Learning in Quantitative Finance

Jian Guo, Liuqing Yang, Zhaoran Wang et al.

Dynamic Datasets and Market Environments for Financial Reinforcement Learning

Jian Guo, Ming Zhu, Daochen Zha et al.

No citations found for this paper.

Comments (0)