Authors

Summary

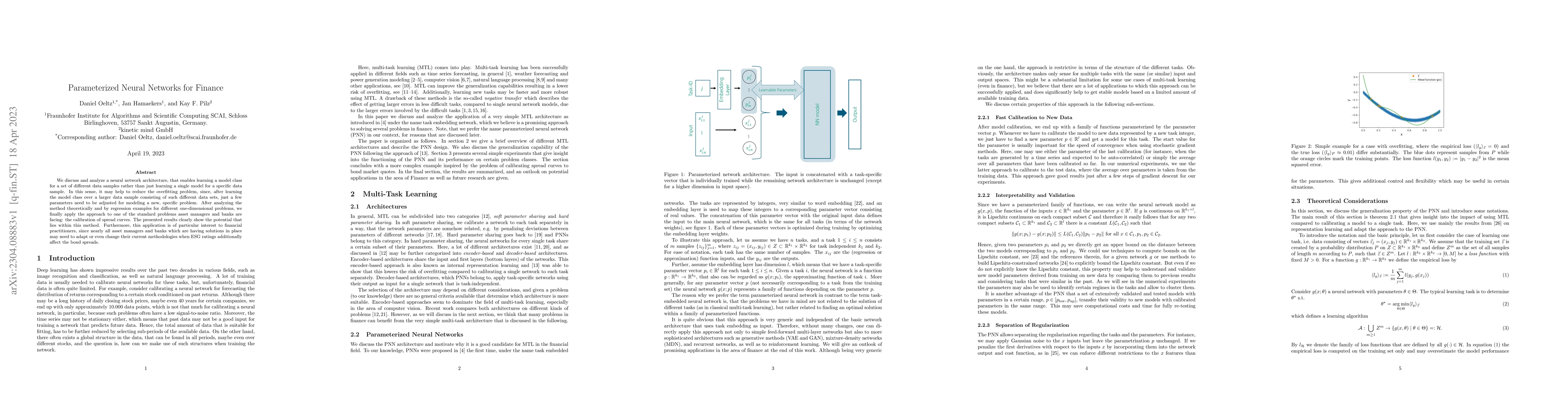

We discuss and analyze a neural network architecture, that enables learning a model class for a set of different data samples rather than just learning a single model for a specific data sample. In this sense, it may help to reduce the overfitting problem, since, after learning the model class over a larger data sample consisting of such different data sets, just a few parameters need to be adjusted for modeling a new, specific problem. After analyzing the method theoretically and by regression examples for different one-dimensional problems, we finally apply the approach to one of the standard problems asset managers and banks are facing: the calibration of spread curves. The presented results clearly show the potential that lies within this method. Furthermore, this application is of particular interest to financial practitioners, since nearly all asset managers and banks which are having solutions in place may need to adapt or even change their current methodologies when ESG ratings additionally affect the bond spreads.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersParameterized Physics-informed Neural Networks for Parameterized PDEs

Noseong Park, Kookjin Lee, Haksoo Lim et al.

No citations found for this paper.

Comments (0)