Authors

Summary

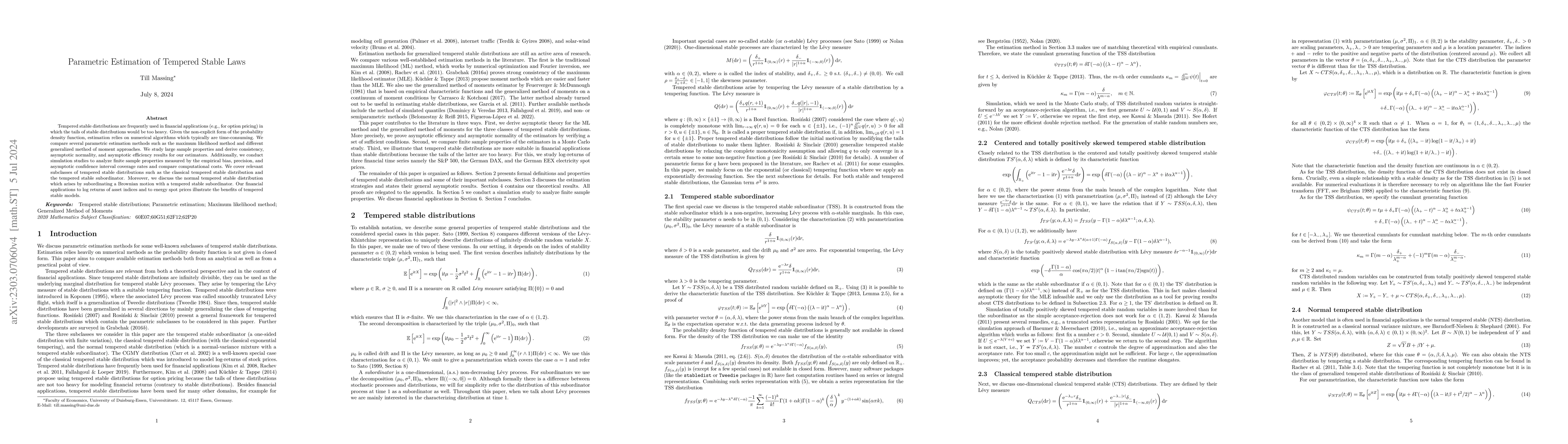

Tempered stable distributions are frequently used in financial applications (e.g., for option pricing) in which the tails of stable distributions would be too heavy. Given the non-explicit form of the probability density function, estimation relies on numerical algorithms which typically are time-consuming. We compare several parametric estimation methods such as the maximum likelihood method and different generalized method of moment approaches. We study large sample properties and derive consistency, asymptotic normality, and asymptotic efficiency results for our estimators. Additionally, we conduct simulation studies to analyze finite sample properties measured by the empirical bias, precision, and asymptotic confidence interval coverage rates and compare computational costs. We cover relevant subclasses of tempered stable distributions such as the classical tempered stable distribution and the tempered stable subordinator. Moreover, we discuss the normal tempered stable distribution which arises by subordinating a Brownian motion with a tempered stable subordinator. Our financial applications to log returns of asset indices and to energy spot prices illustrate the benefits of tempered stable models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)