Summary

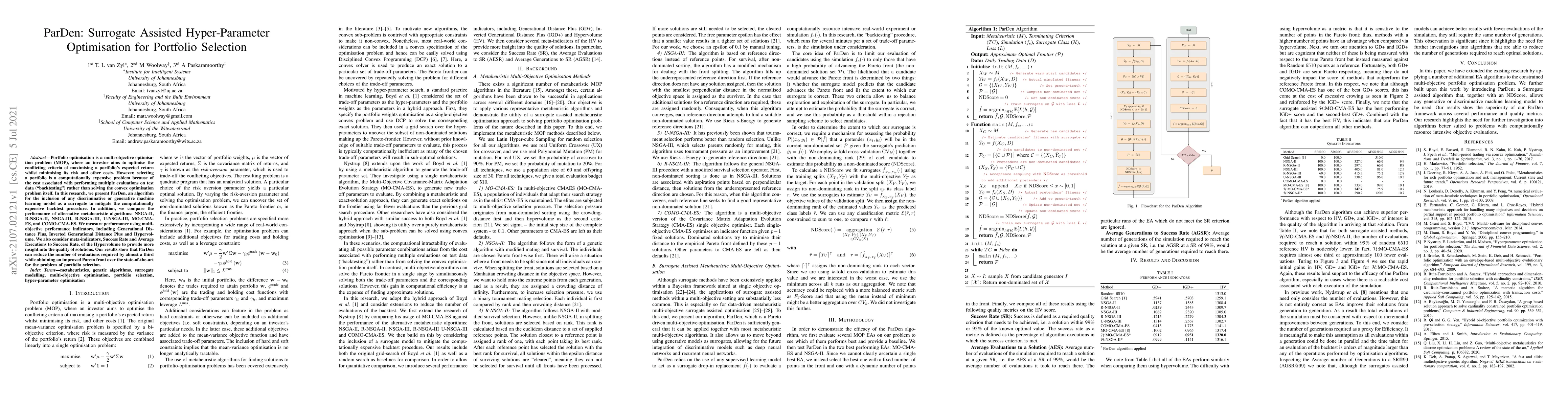

Portfolio optimisation is a multi-objective optimisation problem (MOP), where an investor aims to optimise the conflicting criteria of maximising a portfolio's expected return whilst minimising its risk and other costs. However, selecting a portfolio is a computationally expensive problem because of the cost associated with performing multiple evaluations on test data ("backtesting") rather than solving the convex optimisation problem itself. In this research, we present ParDen, an algorithm for the inclusion of any discriminative or generative machine learning model as a surrogate to mitigate the computationally expensive backtest procedure. In addition, we compare the performance of alternative metaheuristic algorithms: NSGA-II, R-NSGA-II, NSGA-III, R-NSGA-III, U-NSGA-III, MO-CMA-ES, and COMO-CMA-ES. We measure performance using multi-objective performance indicators, including Generational Distance Plus, Inverted Generational Distance Plus and Hypervolume. We also consider meta-indicators, Success Rate and Average Executions to Success Rate, of the Hypervolume to provide more insight into the quality of solutions. Our results show that ParDen can reduce the number of evaluations required by almost a third while obtaining an improved Pareto front over the state-of-the-art for the problem of portfolio selection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPareto Driven Surrogate (ParDen-Sur) Assisted Optimisation of Multi-period Portfolio Backtest Simulations

Andrew Paskaramoorthy, Terence L. van Zyl, Matthew Woolway

Surrogate-assisted distributed swarm optimisation for computationally expensive geoscientific models

Rohitash Chandra, Yash Vardhan Sharma

| Title | Authors | Year | Actions |

|---|

Comments (0)