Summary

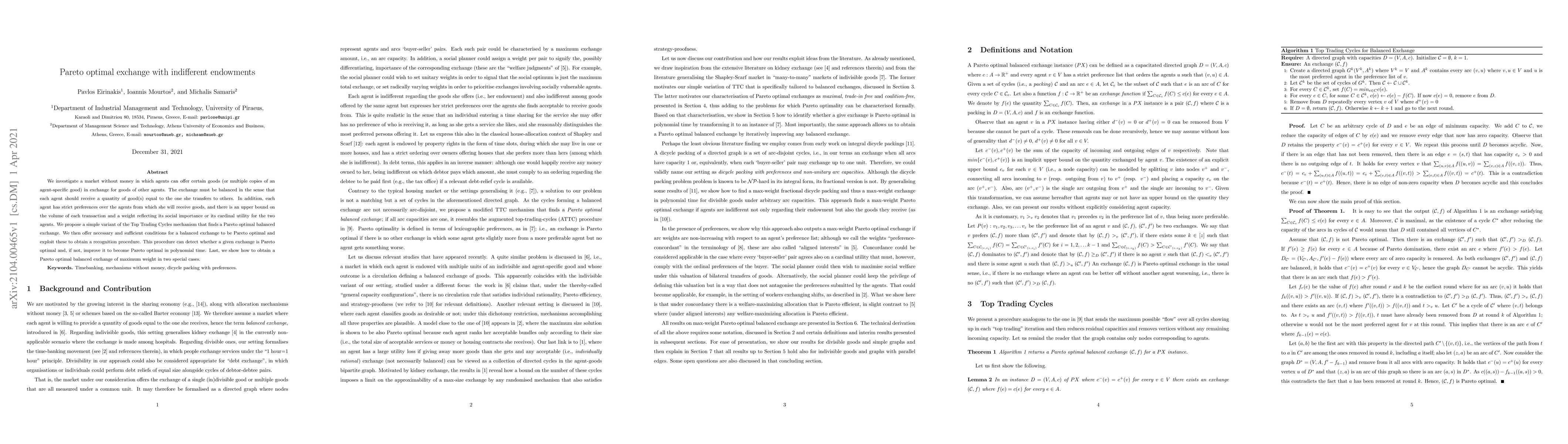

We investigate a market without money in which agents can offer certain goods (or multiple copies of an agent-specific good) in exchange for goods of other agents. The exchange must be balanced in the sense that each agent should receive a quantity of good(s) equal to the one she transfers to others. In addition, each agent has strict preferences over the agents from which she will receive goods, and there is an upper bound on the volume of each transaction and a weight reflecting its social importance or its cardinal utility for the two agents. We propose a simple variant of the Top Trading Cycles mechanism that finds a Pareto optimal balanced exchange. We then offer necessary and sufficient conditions for a balanced exchange to be Pareto optimal and exploit these to obtain a recognition procedure. This procedure can detect whether a given exchange is Pareto optimal and, if not, improve it to become Pareto optimal in polynomial time. Last, we show how to obtain a Pareto optimal balanced exchange of maximum weight in two special cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)