Summary

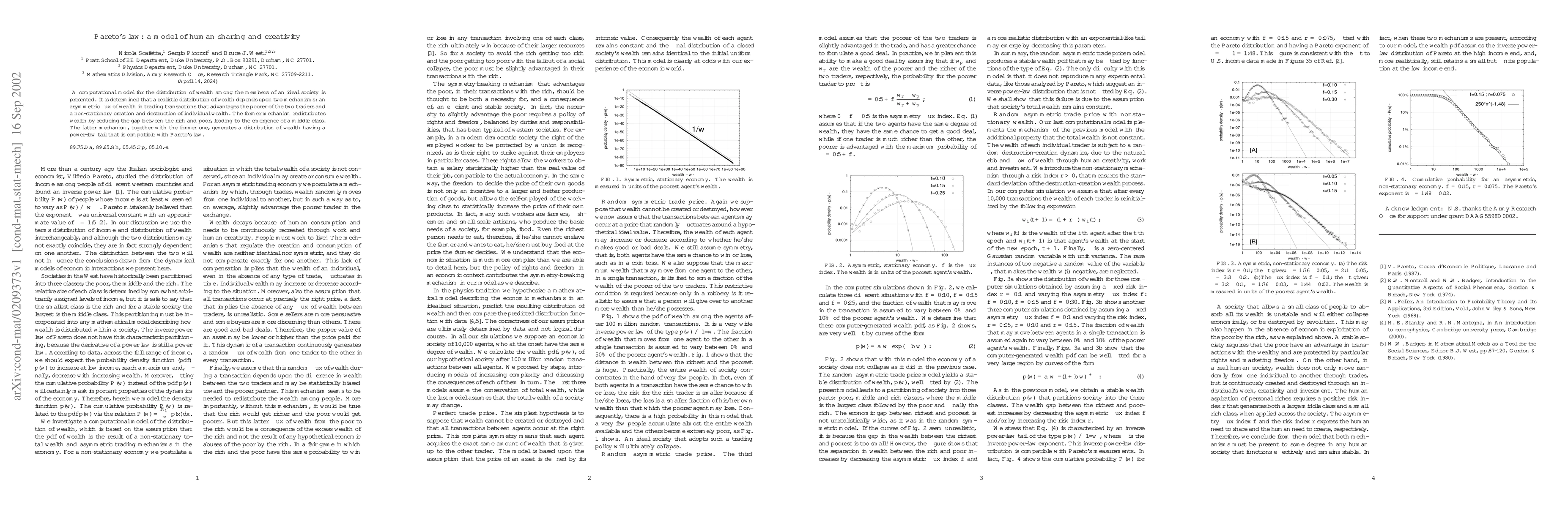

A computational model for the distribution of wealth among the members of an ideal society is presented. It is determined that a realistic distribution of wealth depends upon two mechanisms: an asymmetric flux of wealth in trading transactions that advantages the poorer of the two traders and a non-stationary creation and destruction of individual wealth. The former mechanism redistributes wealth by reducing the gap between the rich and poor, leading to the emergence of a middle class. The latter mechanism, together with the former one, generates a distribution of wealth having a power-law tail that is compatible with Pareto's law.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMultiplicative Turing Ensembles, Pareto's Law, and Creativity

Alexander Kolpakov, Aidan Rocke

Comments (0)