Authors

Summary

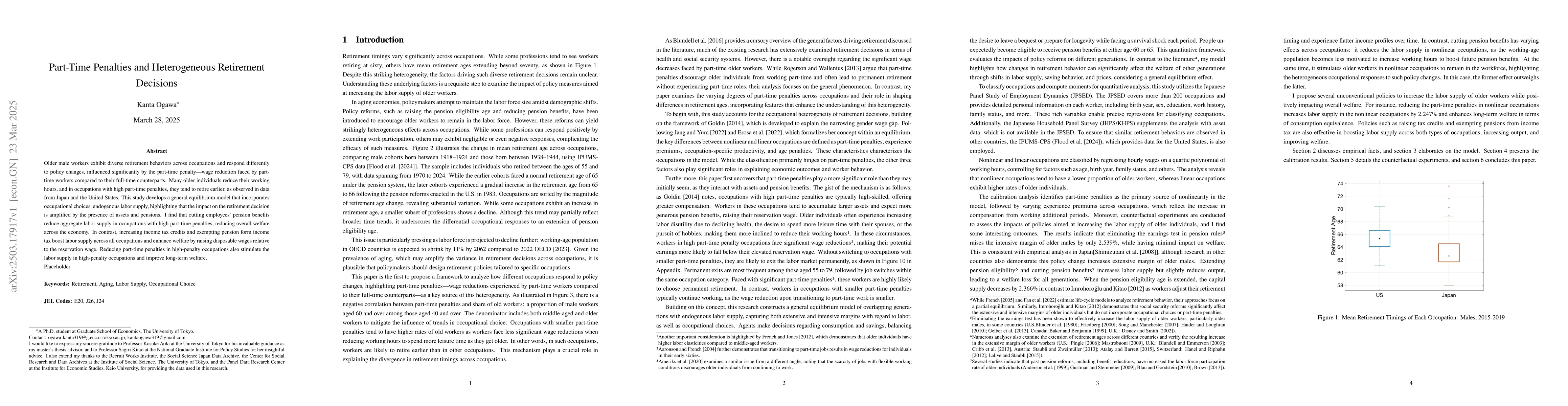

Older male workers exhibit diverse retirement behaviors across occupations and respond differently to policy changes, influenced significantly by the part-time penalty, wage reduction faced by part-time workers compared to their full-time counterparts. Many older individuals reduce their working hours, and in occupations with high part-time penalties, they tend to retire earlier, as observed in data from Japan and the United States. This study develops a general equilibrium model that incorporates occupational choices, endogenous labor supply, highlighting that the impact on the retirement decision is amplified by the presence of assets and pensions. I find that cutting employees' pension benefits reduce aggregate labor supply in occupations with high part-time penalties in Japan, reducing overall welfare across the economy. In contrast, increasing income tax credits and exempting pension form income tax boost labor supply across all occupations and enhance welfare by raising disposable wages relative to the reservation wage. Reducing part-time penalties in high-penalty occupations also stimulate the labor supply in high-penalty occupations and improve long-term welfare.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper develops a general equilibrium model incorporating occupational choices and endogenous labor supply to analyze the impact of part-time penalties on retirement decisions.

Key Results

- Older male workers in Japan and the US with high part-time penalties tend to retire earlier when reducing working hours.

- Cutting pension benefits in high-penalty occupations reduces aggregate labor supply and overall welfare in Japan.

- Increasing income tax credits and exempting pensions from income tax boosts labor supply across all occupations and enhances welfare.

Significance

This research is important for understanding how policy changes affect retirement decisions and labor supply, particularly in occupations with high part-time penalties, with potential implications for policymakers in Japan and beyond.

Technical Contribution

The paper presents a general equilibrium model that accounts for occupational choices and endogenous labor supply to assess the influence of part-time penalties on retirement decisions.

Novelty

This research distinguishes itself by emphasizing the heterogeneous retirement behaviors across occupations and the amplified impact of part-time penalties in the presence of assets and pensions.

Limitations

- The study focuses on older male workers, potentially overlooking the experiences of women and other demographic groups.

- Findings are based on data from Japan and the US, which may limit the generalizability of results to other countries or contexts.

Future Work

- Investigate the impact of part-time penalties on retirement decisions in other demographic groups and countries.

- Explore the effects of additional policy interventions on labor supply and welfare in various occupational and national contexts.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Investment, Heterogeneous Consumption and Best Time for Retirement

Harry Zheng, Zuo Quan Xu, Hyun Jin Jang

Impact Of Income And Leisure On Optimal Portfolio, Consumption, Retirement Decisions Under Exponential Utility

Tae Ung Gang, Yong Hyun Shin

No citations found for this paper.

Comments (0)