Summary

New estimators for the mean and the covariance function for partially observed functional data are proposed using a detour via the fundamental theorem of calculus. The new estimators allow for a consistent estimation of the mean and covariance function under specific violations of the missing-completely-at-random assumption. The requirements of the estimation procedure can be tested using a sequential multiple hypothesis test procedure. An extensive simulation study compares the new estimators with the classical estimators from the literature in different missing data scenarios. The proposed methodology is motivated by the practical problem of estimating the mean price curve in the German Control Reserve Market. In this auction market, price curves are only partially observable and the underlying missing data mechanism depends on systematic trading strategies which clearly violate the missing-completely-at-random assumption. In contrast to the classical estimators, the new estimators lead to useful estimates of the mean and covariance functions. Supplementary materials are provided online.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

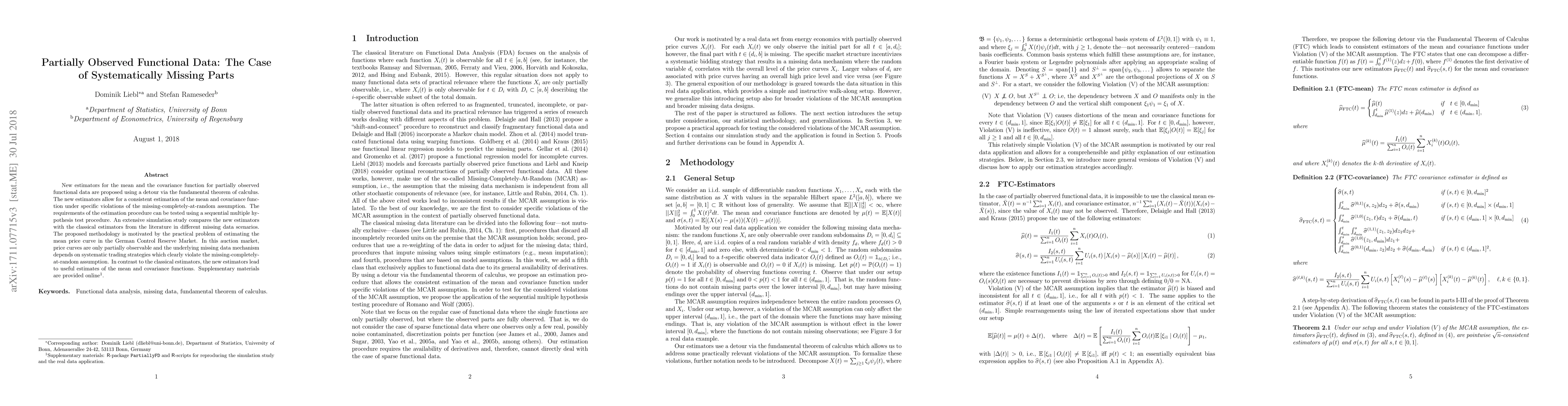

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCovariate-informed reconstruction of partially observed functional data via factor models

Maximilian Ofner, Siegfried Hörmann

| Title | Authors | Year | Actions |

|---|

Comments (0)