Authors

Summary

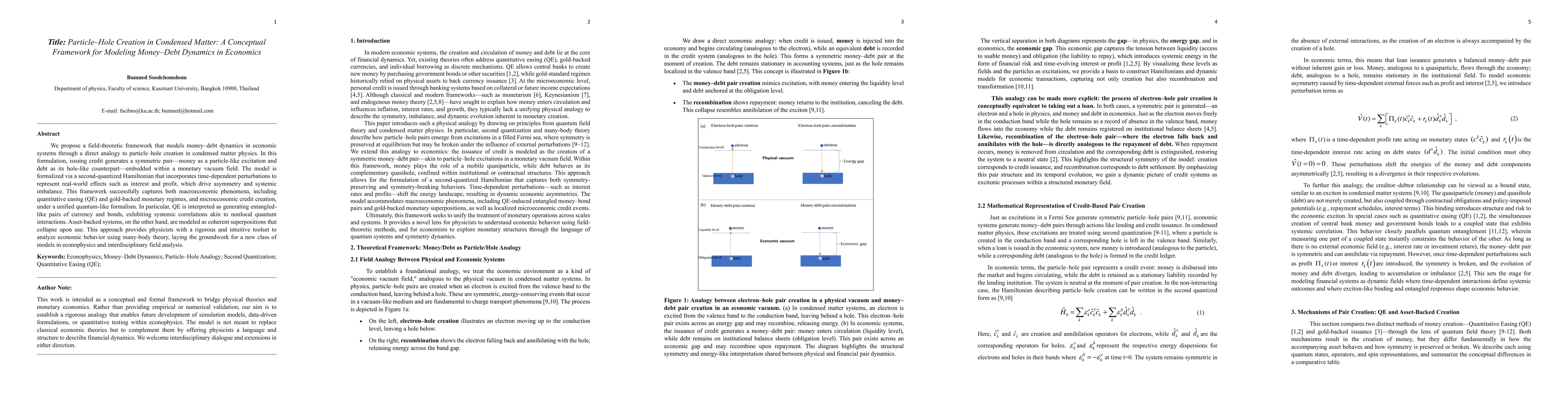

We propose a field-theoretic framework that models money-debt dynamics in economic systems through a direct analogy to particle-hole creation in condensed matter physics. In this formulation, issuing credit generates a symmetric pair-money as a particle-like excitation and debt as its hole-like counterpart-embedded within a monetary vacuum field. The model is formalized via a second-quantized Hamiltonian that incorporates time-dependent perturbations to represent real-world effects such as interest and profit, which drive asymmetry and systemic imbalance. This framework successfully captures both macroeconomic phenomena, including quantitative easing (QE) and gold-backed monetary regimes, and microeconomic credit creation, under a unified quantum-like formalism. In particular, QE is interpreted as generating entangled-like pairs of currency and bonds, exhibiting systemic correlations akin to nonlocal quantum interactions. Asset-backed systems, on the other hand, are modeled as coherent superpositions that collapse upon use. This approach provides physicists with a rigorous and intuitive toolset to analyze economic behavior using many-body theory, laying the groundwork for a new class of models in econophysics and interdisciplinary field analysis.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research proposes a field-theoretic framework modeling money-debt dynamics using particle-hole creation analogy from condensed matter physics, formalized via a second-quantized Hamiltonian to represent real-world economic effects like interest and profit.

Key Results

- A unified quantum-like formalism captures both macroeconomic phenomena (e.g., quantitative easing) and microeconomic credit creation.

- Quantitative easing is interpreted as generating entangled-like pairs of currency and bonds, exhibiting systemic correlations akin to nonlocal quantum interactions.

- Asset-backed systems are modeled as coherent superpositions that collapse upon use.

- The framework reveals deep symmetry logic embedded within monetary creation frameworks.

- A strong systemic correlation between money and bonds created via quantitative easing is highlighted, with the money–bond relationship modeled as a Bell-type entangled state.

Significance

This approach provides physicists with a rigorous and intuitive toolset to analyze economic behavior using many-body theory, laying the groundwork for new econophysics models and interdisciplinary field analysis.

Technical Contribution

The development of a field-theoretic model for monetary dynamics, incorporating second-quantized Hamiltonian to represent time-dependent perturbations like interest and profit.

Novelty

The paper introduces a novel interdisciplinary framework that models monetary creation and credit mechanisms using principles from quantum field theory and condensed matter physics, distinguishing it from traditional economic models.

Limitations

- The model does not account for all complexities of real-world economic systems, such as behavioral aspects of market participants.

- The analogy might oversimplify certain nuances of monetary policy and financial instruments.

Future Work

- Explore the implications of this framework for understanding and predicting financial crises and systemic risk.

- Investigate the potential of this model for informing monetary policy decisions and regulatory frameworks.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)