Summary

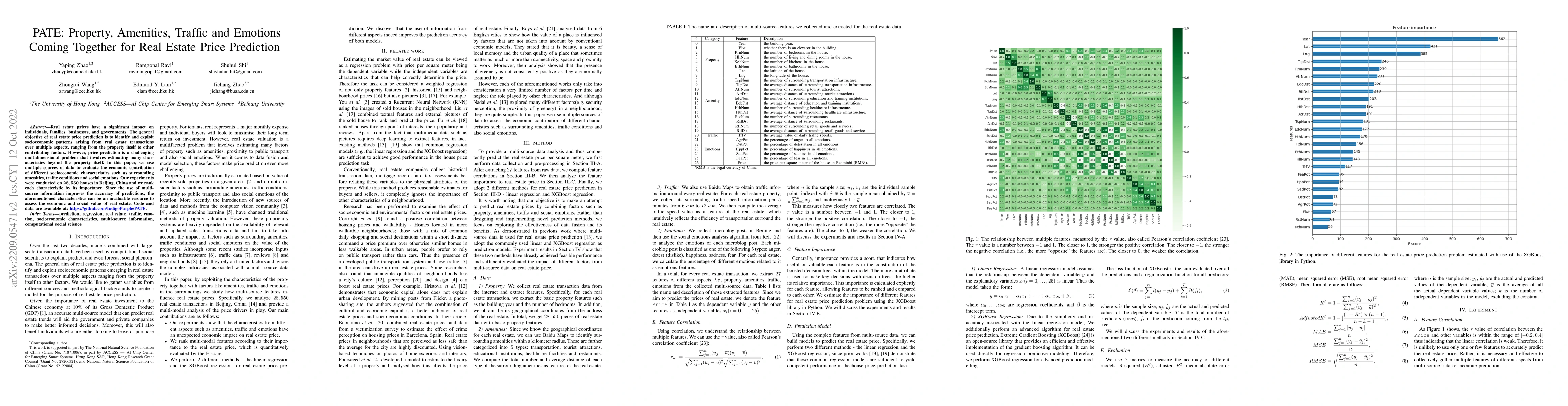

Real estate prices have a significant impact on individuals, families, businesses, and governments. The general objective of real estate price prediction is to identify and exploit socioeconomic patterns arising from real estate transactions over multiple aspects, ranging from the property itself to other contributing factors. However, price prediction is a challenging multidimensional problem that involves estimating many characteristics beyond the property itself. In this paper, we use multiple sources of data to evaluate the economic contribution of different socioeconomic characteristics such as surrounding amenities, traffic conditions and social emotions. Our experiments were conducted on 28,550 houses in Beijing, China and we rank each characteristic by its importance. Since the use of multi-source information improves the accuracy of predictions, the aforementioned characteristics can be an invaluable resource to assess the economic and social value of real estate. Code and data are available at: https://github.com/IndigoPurple/PATE

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA model for predicting price polarity of real estate properties using information of real estate market websites

Vladimir Vargas-Calderón, Jorge E. Camargo

| Title | Authors | Year | Actions |

|---|

Comments (0)