Summary

Path integral method in quantum mechanics provides a new thinking for barrier option pricing. For proportional double-barrier step (PDBS) options, the option price changing process is analogous to a particle moving in a finite symmetric square potential well. We have derived the pricing kernel of PDBS options with time dependent interest rate and volatility. Numerical results of option price as a function of underlying asset price are shown as well. Path integral method can be easily generalized to the pricing of PDBS options with curved boundaries.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

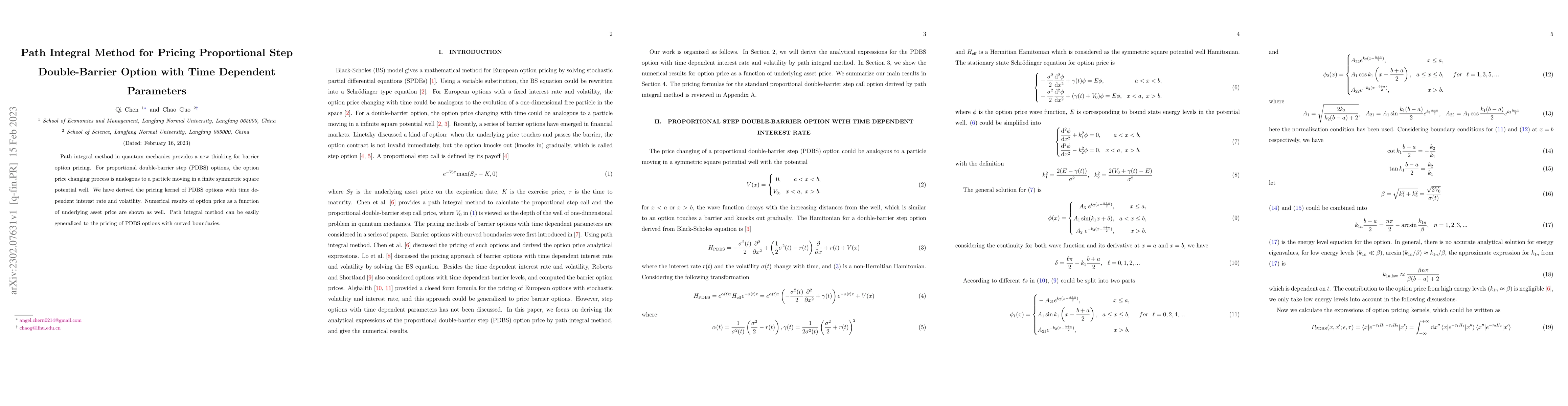

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)