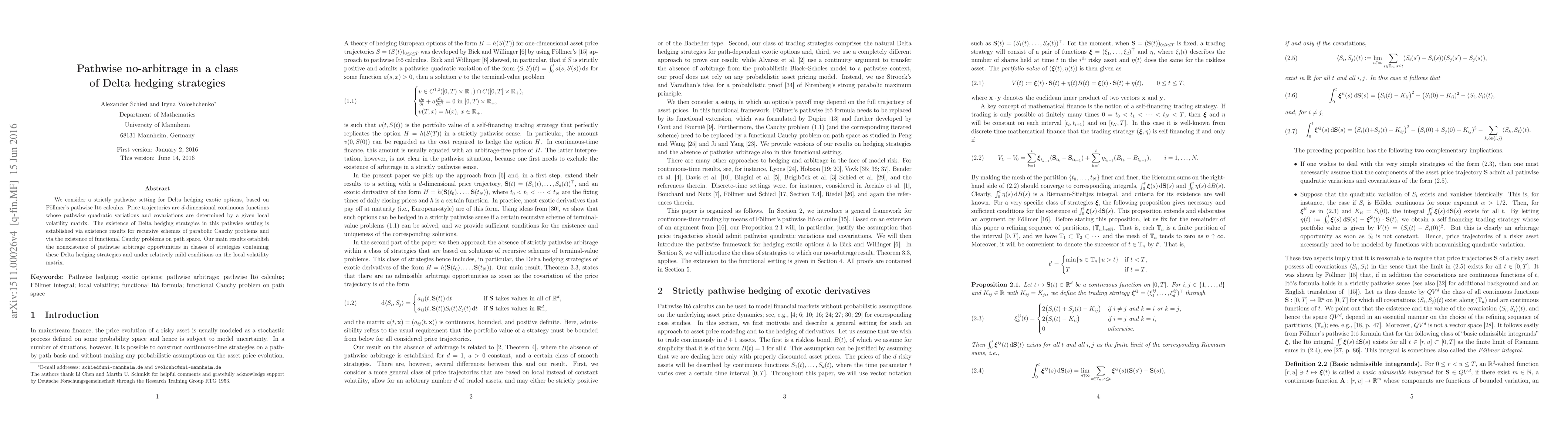

Summary

We consider a strictly pathwise setting for Delta hedging exotic options, based on F\"ollmer's pathwise It\=o calculus. Price trajectories are $d$-dimensional continuous functions whose pathwise quadratic variations and covariations are determined by a given local volatility matrix. The existence of Delta hedging strategies in this pathwise setting is established via existence results for recursive schemes of parabolic Cauchy problems and via the existence of functional Cauchy problems on path space. Our main results establish the nonexistence of pathwise arbitrage opportunities in classes of strategies containing these Delta hedging strategies and under relatively mild conditions on the local volatility matrix.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIs the difference between deep hedging and delta hedging a statistical arbitrage?

Pascal François, Geneviève Gauthier, Frédéric Godin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)