Summary

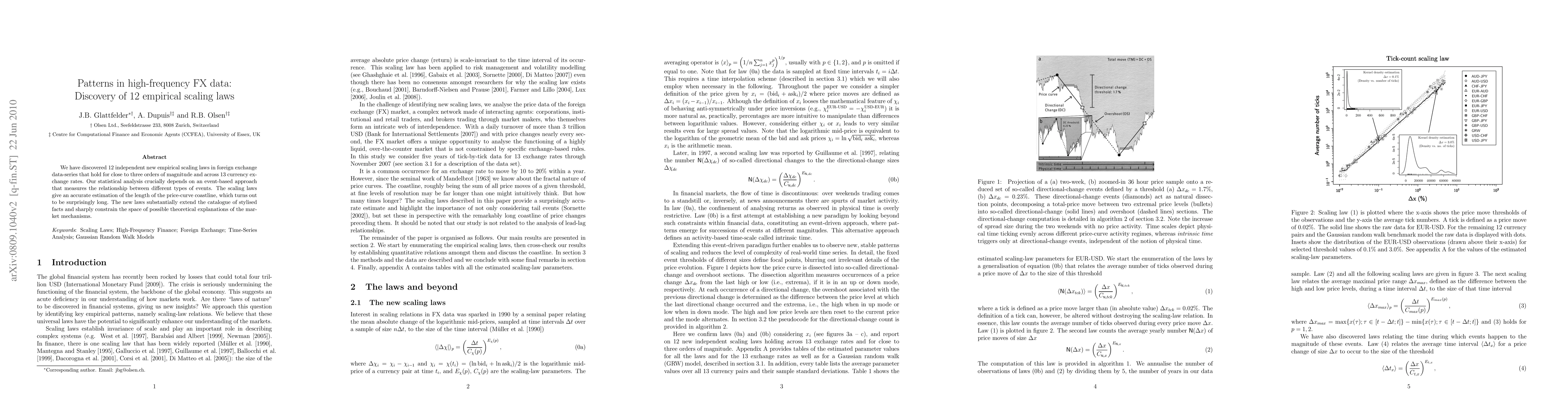

We have discovered 12 independent new empirical scaling laws in foreign exchange data-series that hold for close to three orders of magnitude and across 13 currency exchange rates. Our statistical analysis crucially depends on an event-based approach that measures the relationship between different types of events. The scaling laws give an accurate estimation of the length of the price-curve coastline, which turns out to be surprisingly long. The new laws substantially extend the catalogue of stylised facts and sharply constrain the space of possible theoretical explanations of the market mechanisms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)