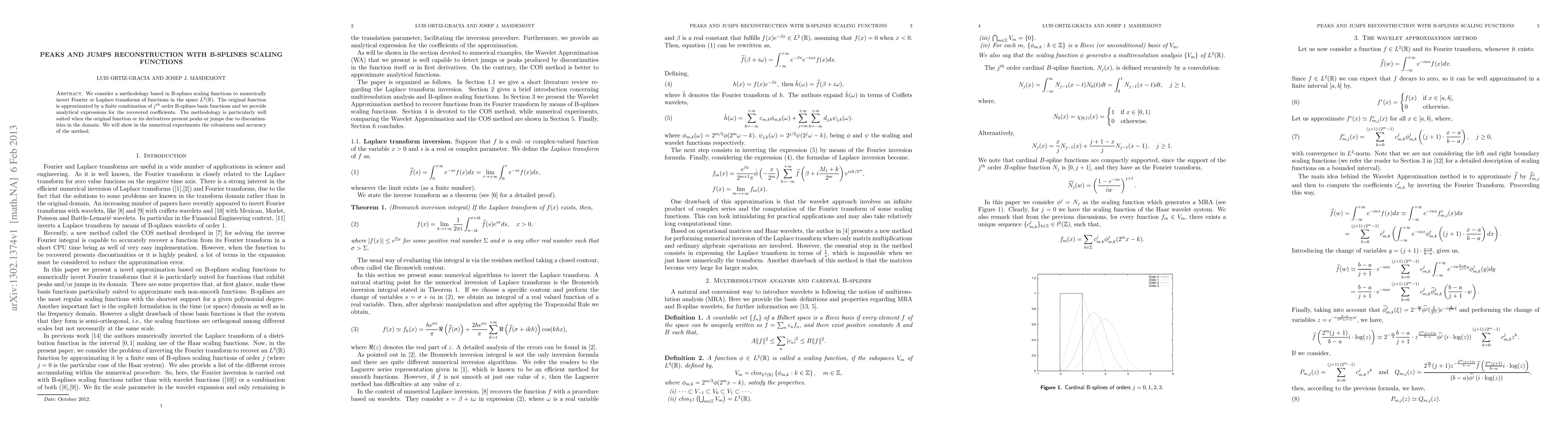

Summary

We consider a methodology based in B-splines scaling functions to numerically invert Fourier or Laplace transforms of functions in the space $L^2(\mathbb{R})$. The original function is approximated by a finite combination of $j^{th}$ order B-splines basis functions and we provide analytical expressions for the recovered coefficients. The methodology is particularly well suited when the original function or its derivatives present peaks or jumps due to discontinuities in the domain. We will show in the numerical experiments the robustness and accuracy of the method.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnisotropic refinable functions and the tile B-splines

Vladimir Yu. Protasov, Tatyana Zaitseva

B-splines and kernels of trigonometric interpolation splines

Volodymyr Denysiuk, Olena Hryshko

| Title | Authors | Year | Actions |

|---|

Comments (0)