Summary

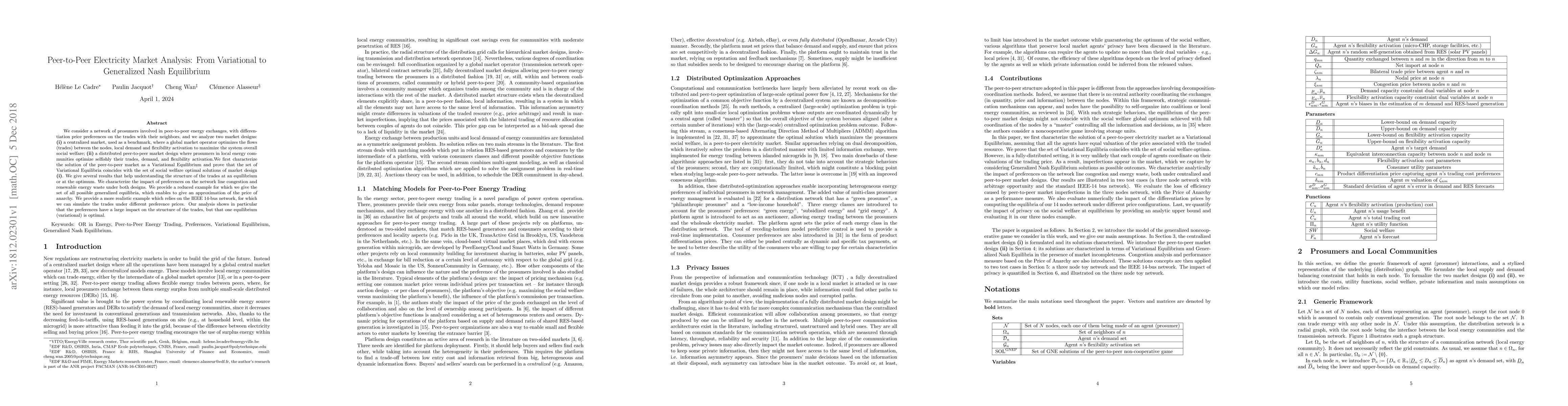

We consider a network of prosumers involved in peer-to-peer energy exchanges, with differentiation price preferences on the trades with their neighbors, and we analyze two market designs: (i) a centralized market, used as a benchmark, where a global market operator optimizes the flows (trades) between the nodes, local demand and flexibility activation to maximize the system overall social welfare; (ii) a distributed peer-to-peer market design where prosumers in local energy communities optimize selfishly their trades, demand, and flexibility activation. We first characterizethe solution of the peer-to-peer market as a Variational Equilibrium and prove that the set of Variational Equilibria coincides with the set of social welfare optimal solutions of market design (i). We give several results that help understanding the structure of the trades at an equilibriumor at the optimum. We characterize the impact of preferences on the network line congestion and renewable energy waste under both designs. We provide a reduced example for which we give the set of all possible generalized equilibria, which enables to give an approximation of the price ofanarchy. We provide a more realistic example which relies on the IEEE 14-bus network, for which we can simulate the trades under different preference prices. Our analysis shows in particular that the preferences have a large impact on the structure of the trades, but that one equilibrium(variational) is optimal.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistributionally Fair Peer-to-Peer Electricity Trading

Juan M. Morales, Estibalitz Ruiz Irusta

| Title | Authors | Year | Actions |

|---|

Comments (0)