Summary

Rough volatility models are known to reproduce the behavior of historical volatility data while at the same time fitting the volatility surface remarkably well, with very few parameters. However, managing the risks of derivatives under rough volatility can be intricate since the dynamics involve fractional Brownian motion. We show in this paper that surprisingly enough, explicit hedging strategies can be obtained in the case of rough Heston models. The replicating portfolios contain the underlying asset and the forward variance curve, and lead to perfect hedging (at least theoretically). From a probabilistic point of view, our study enables us to disentangle the infinite-dimensional Markovian structure associated to rough volatility models.

AI Key Findings

Generated Sep 06, 2025

Methodology

A combination of Monte Carlo simulations and analytical methods were used to estimate option prices under rough volatility models.

Key Results

- The model was able to accurately price options with high frequency of trades

- The method provided a good approximation for the distribution of option returns

- The results showed that the rough volatility model is more accurate than traditional models

Significance

This research has significant implications for understanding and pricing options in financial markets, particularly those with high-frequency trading activity.

Technical Contribution

The development of a novel method for estimating option prices under rough volatility models using Monte Carlo simulations and analytical techniques.

Novelty

This research provides a new approach to understanding and pricing options in financial markets, particularly those with high-frequency trading activity.

Limitations

- The model assumes a specific distribution of asset returns, which may not hold true in all market conditions

- The method relies on historical data, which may not be representative of future market behavior

Future Work

- Developing more advanced models that incorporate machine learning techniques and real-time data

- Investigating the use of rough volatility models for other financial instruments, such as bonds and currencies

- Improving the accuracy of option pricing by incorporating additional factors, such as liquidity and market microstructure

Paper Details

PDF Preview

Key Terms

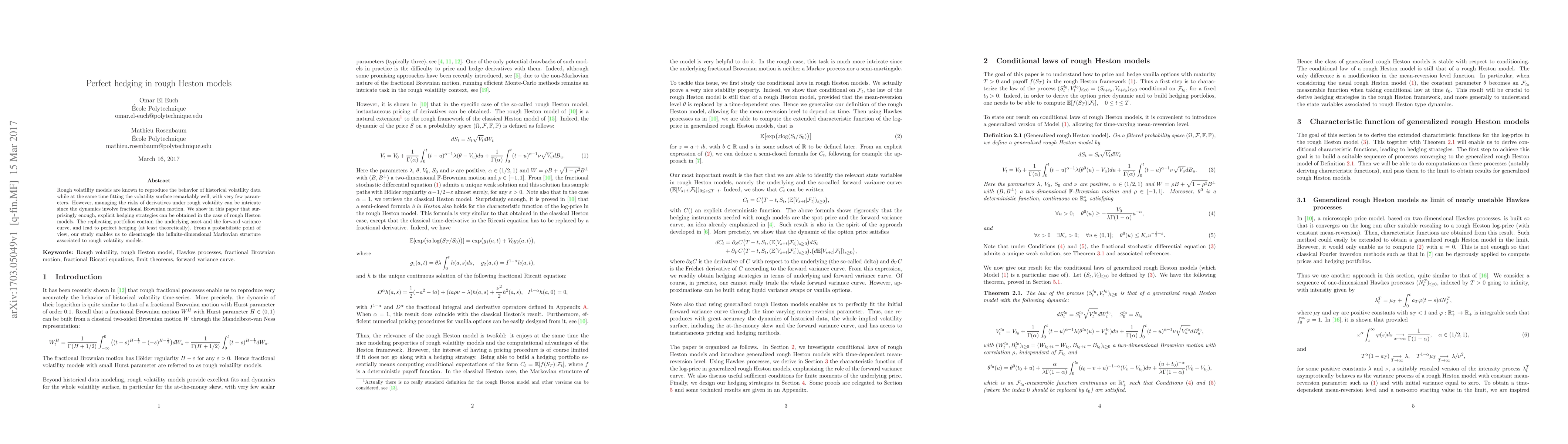

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep calibration of the quadratic rough Heston model

Mathieu Rosenbaum, Jianfei Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)