Summary

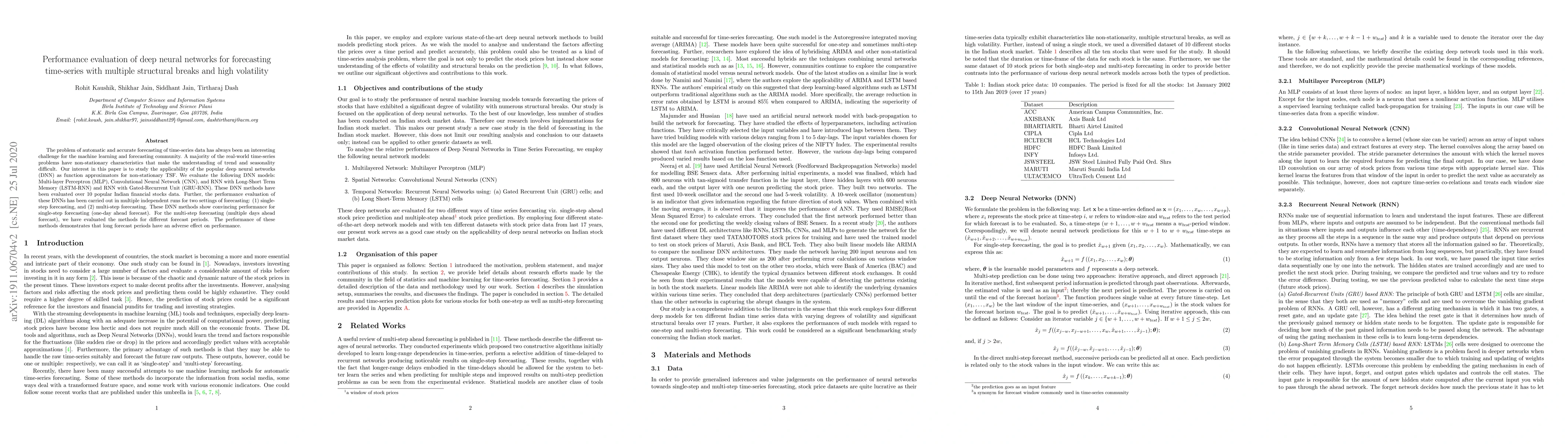

The problem of automatic and accurate forecasting of time-series data has always been an interesting challenge for the machine learning and forecasting community. A majority of the real-world time-series problems have non-stationary characteristics that make the understanding of trend and seasonality difficult. Our interest in this paper is to study the applicability of the popular deep neural networks (DNN) as function approximators for non-stationary TSF. We evaluate the following DNN models: Multi-layer Perceptron (MLP), Convolutional Neural Network (CNN), and RNN with Long-Short Term Memory (LSTM-RNN) and RNN with Gated-Recurrent Unit (GRU-RNN). These DNN methods have been evaluated over 10 popular Indian financial stocks data. Further, the performance evaluation of these DNNs has been carried out in multiple independent runs for two settings of forecasting: (1) single-step forecasting, and (2) multi-step forecasting. These DNN methods show convincing performance for single-step forecasting (one-day ahead forecast). For the multi-step forecasting (multiple days ahead forecast), we have evaluated the methods for different forecast periods. The performance of these methods demonstrates that long forecast periods have an adverse effect on performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)