Summary

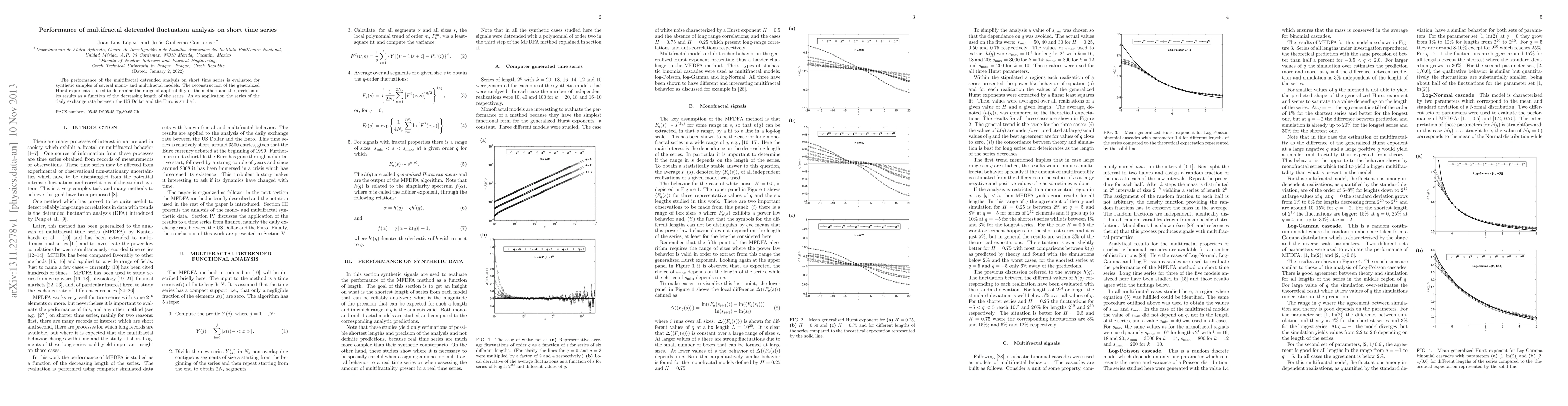

The performance of the multifractal detrended analysis on short time series is evaluated for synthetic samples of several mono- and multifractal models. The reconstruction of the generalized Hurst exponents is used to determine the range of applicability of the method and the precision of its results as a function of the decreasing length of the series. As an application the series of the daily exchange rate between the U.S. dollar and the euro is studied.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMultifractal detrended fluctuation analysis of rainfall time series in the Guadeloupe archipelago

J. Gomez-Gomez, T. Plocoste, E. Alexis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)