Summary

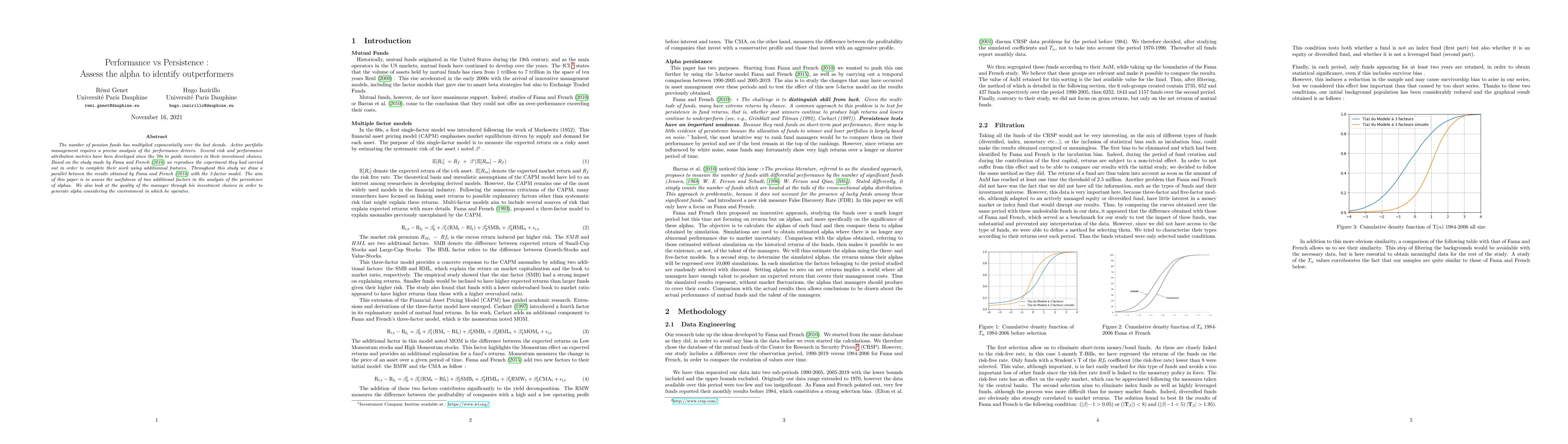

The number of pension funds has multiplied exponentially over the last decade. Active portfolio management requires a precise analysis of the performance drivers. Several risk and performance attribution metrics have been developed since the 70s to guide investors in their investment choices. Based on the study made by Fama and French (2010) we reproduce the experiment they had carried out in order to complete their work using additionnal features. Throughout this study we draw a parallel between the results obtained by Fama and French (2010) with the 3-factor model. The aim of this paper is to assess the usefulness of two additional factors in the analysis of the persistence of alphas. We also look at the quality of the manager through his investment choices in order to generate alpha considering the environment in which he operates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)