Authors

Summary

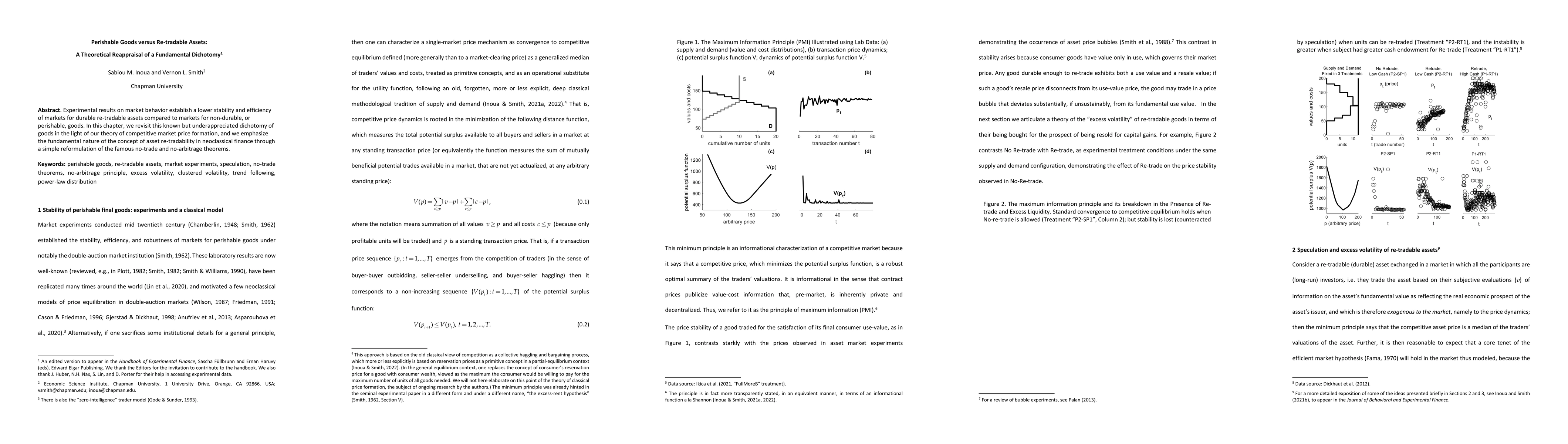

Experimental results on market behavior establish a lower stability and efficiency of markets for durable re-tradable assets compared to markets for non-durable, or perishable, goods. In this chapter, we revisit this known but underappreciated dichotomy of goods in the light of our theory of competitive market price formation, and we emphasize the fundamental nature of the concept of asset re-tradability in neoclassical finance through a simple reformulation of the famous no-trade and no-arbitrage theorems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Pickup and Delivery Problem with Crossdock for Perishable Goods

Konstantinos Gkiotsalitis, Amalia Nikolopoulou

Traditional lectures versus active learning -- a false dichotomy?

Heiko Dietrich, Tanya Evans

No citations found for this paper.

Comments (0)