Authors

Summary

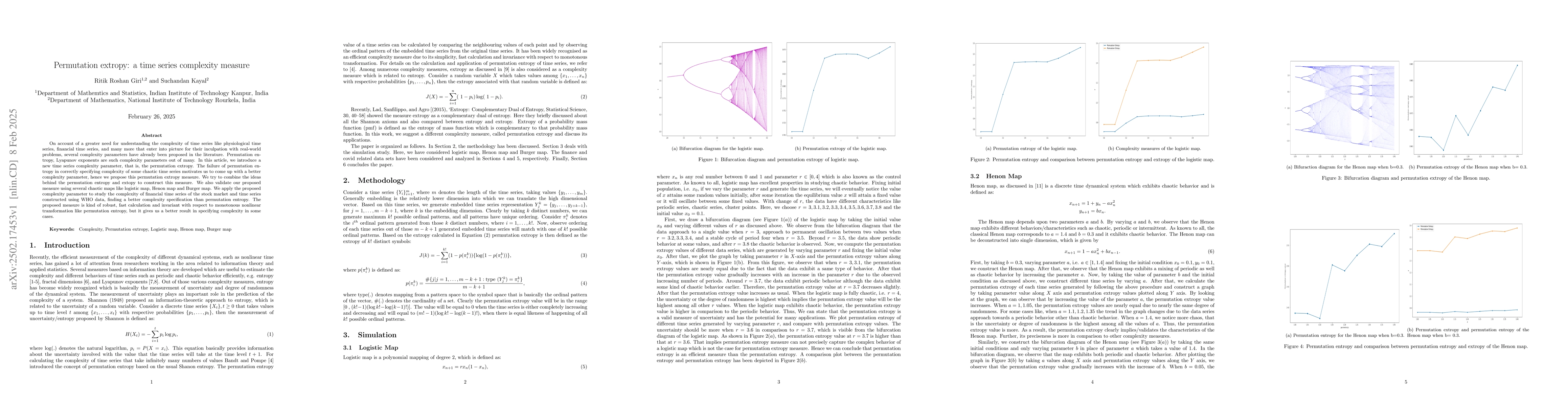

On account of a greater need for understanding the complexity of time series like physiological time series, financial time series, and many more that enter into picture for their inculpation with real-world problems, several complexity parameters have already been proposed in the literature. Permutation entropy, Lyapunov exponents are such complexity parameters out of many. In this article, we introduce a new time series complexity parameter, that is, the permutation extropy. The failure of permutation entropy in correctly specifying complexity of some chaotic time series motivates us to come up with a better complexity parameter, hence we propose this permutation extropy measure. We try to combine the ideas behind the permutation entropy and extopy to construct this measure. We also validate our proposed measure using several chaotic maps like logistic map, Henon map and Burger map. We apply the proposed complexity parameter to study the complexity of financial time series of the stock market and time series constructed using WHO data, finding a better complexity specification than permutation entropy. The proposed measure is kind of robust, fast calculation and invariant with respect to monotonous nonlinear transformation like permutation entropy, but it gives us a better result in specifying complexity in some cases.

AI Key Findings

Generated Jun 11, 2025

Methodology

The paper introduces permutation extropy, a new time series complexity measure combining ideas from permutation entropy and extropy. It validates the proposed measure using chaotic maps like logistic, Henon, and Burger maps, and applies it to financial time series and WHO data for complexity specification.

Key Results

- Permutation extropy combines permutation entropy and extropy concepts to create a new complexity measure.

- Permutation extropy shows robustness, fast calculation, and invariance to monotonic nonlinear transformations.

- Permutation extropy better specifies the complexity of chaotic time series compared to permutation entropy.

- The measure is validated using logistic, Henon, and Burger maps, demonstrating its effectiveness in capturing chaotic and periodic behaviors.

- Permutation extropy is applied to financial time series and WHO data, providing better complexity specification.

Significance

This research is significant as it addresses the need for better time series complexity measures, especially for physiological and financial time series, by proposing permutation extropy, which outperforms permutation entropy in some cases.

Technical Contribution

The main technical contribution is the introduction and validation of permutation extropy, a novel time series complexity measure combining permutation entropy and extropy concepts.

Novelty

Permutation extropy is novel as it addresses the shortcomings of permutation entropy by incorporating extropy, resulting in a more reliable and robust complexity measure for various time series, including chaotic and financial data.

Limitations

- The paper does not discuss potential limitations or drawbacks of the proposed permutation extropy measure.

- No comparison is provided with other state-of-the-art complexity measures beyond permutation entropy.

Future Work

- Further investigation into the performance of permutation extropy on diverse time series datasets.

- Development of weighted and multi-scale permutation extropy measures for enhanced complexity analysis.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)