Authors

Summary

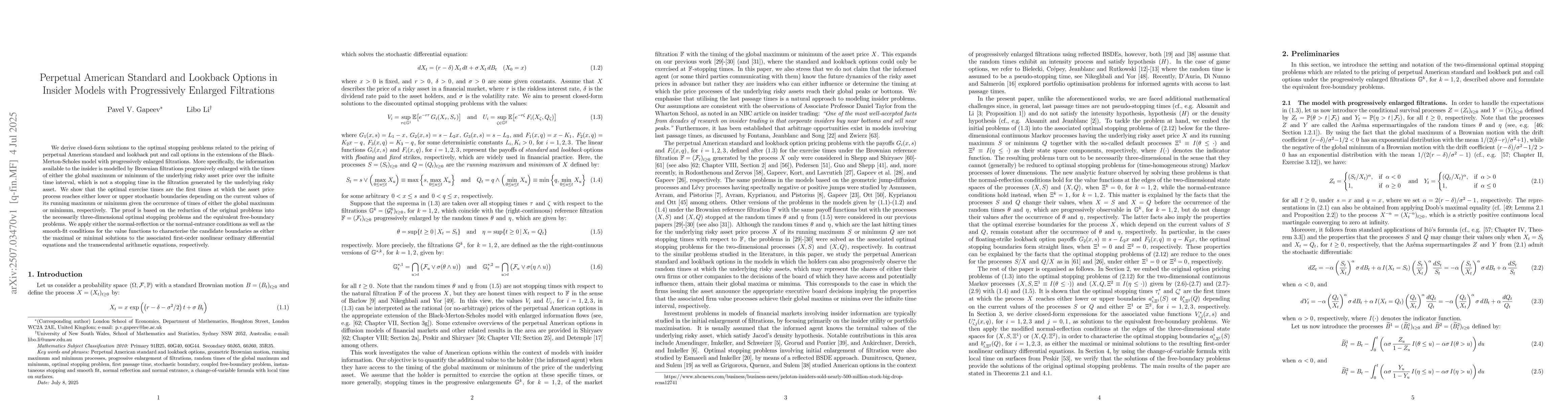

We derive closed-form solutions to the optimal stopping problems related to the pricing of perpetual American standard and lookback put and call options in the extensions of the Black-Merton-Scholes model with progressively enlarged filtrations. More specifically, the information available to the insider is modelled by Brownian filtrations progressively enlarged with the times of either the global maximum or minimum of the underlying risky asset price over the infinite time interval, which is not a stopping time in the filtration generated by the underlying risky asset. We show that the optimal exercise times are the first times at which the asset price process reaches either lower or upper stochastic boundaries depending on the current values of its running maximum or minimum given the occurrence of times of either the global maximum or minimum, respectively. The proof is based on the reduction of the original problems into the necessarily three-dimensional optimal stopping problems and the equivalent free-boundary problems. We apply either the normal-reflection or the normal-entrance conditions as well as the smooth-fit conditions for the value functions to characterise the candidate boundaries as either the maximal or minimal solutions to the associated first-order nonlinear ordinary differential equations and the transcendental arithmetic equations, respectively.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)