Summary

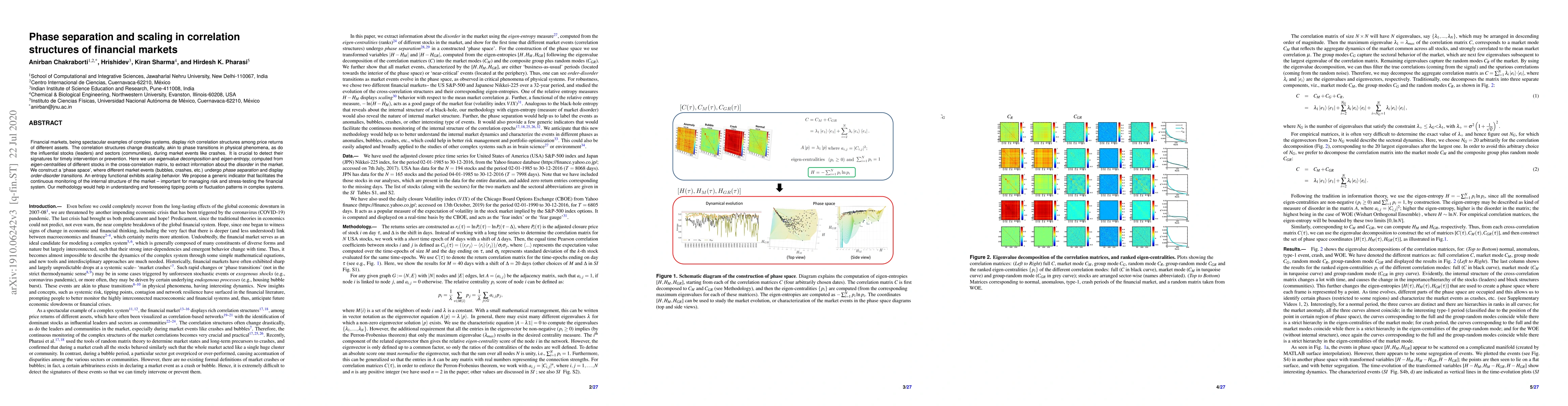

Financial markets, being spectacular examples of complex systems, display rich correlation structures among price returns of different assets. The correlation structures change drastically, akin to phase transitions in physical phenomena, as do the influential stocks (leaders) and sectors (communities), during market events like crashes. It is crucial to detect their signatures for timely intervention or prevention. Here we use eigenvalue decomposition and eigen-entropy, computed from eigen-centralities of different stocks in the cross-correlation matrix, to extract information about the disorder in the market. We construct a `phase space', where different market events (bubbles, crashes, etc.) undergo phase separation and display order-disorder transitions. An entropy functional exhibits scaling behavior. We propose a generic indicator that facilitates the continuous monitoring of the internal structure of the market -- important for managing risk and stress-testing the financial system. Our methodology would help in understanding and foreseeing tipping points or fluctuation patterns in complex systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTesting for asymmetric dependency structures in financial markets: regime-switching and local Gaussian correlation

Kristian Gundersen, Timothée Bacri, Jan Bulla et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)