Summary

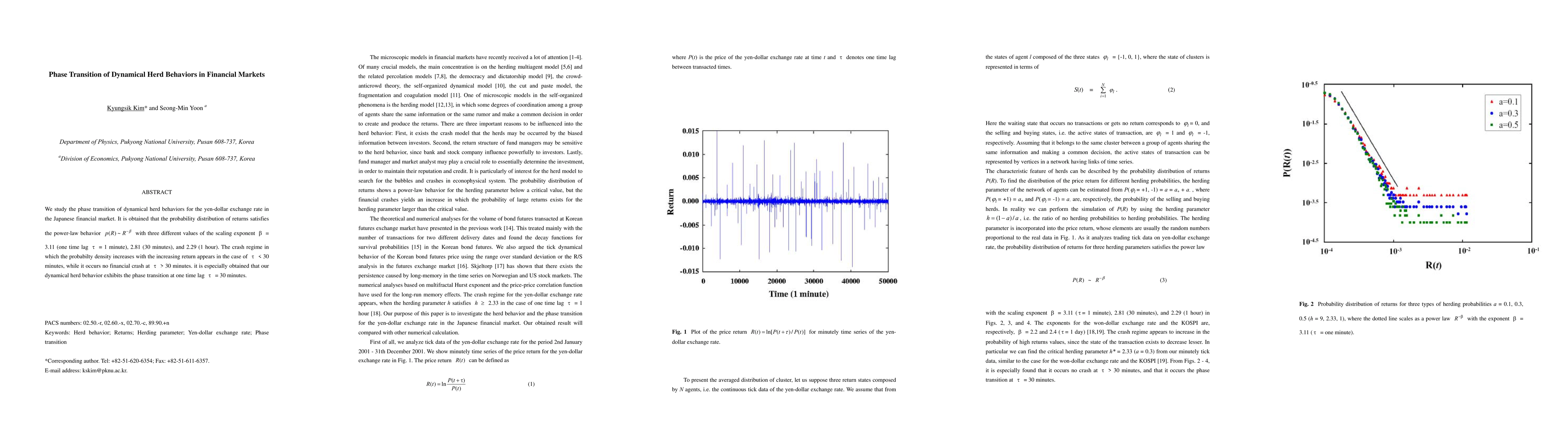

We study the phase transition of dynamical herd behaviors for the yen-dollar exchange rate in the Japanese financial market. It is obtained that the probability distribution of returns satisfies the power-law behavior with three different values of the scaling exponent 3.11 (one time lag $\tau$ = 1 minute), 2.81 (30 minutes), and 2.29 (1 hour). The crash regime in which the probabilty density increases with the increasing return appears in the case of $\tau$ < 30 minutes, while it occurs no financial crash at $\tau$ > 30 minutes. it is especially obtained that our dynamical herd behavior exhibits the phase transition at one time lag $\tau$ = 30 minutes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)