Summary

The present paper analyses the formal parallelism existing between the laws of thermodynamics and some economic principles. Based on previous works, we shall show how the existence in Economics of principles analogous to those in thermodynamics involves the occurrence of economic events that remind of well-known phenomenological thermodynamic paradigms (i.e., the magnetocaloric effect and population inversion). We shall also show how the phase transition and renormalization theory provides a natural framework to understand and predict trend changes in stock markets. Finally, current negotiation strategies in financial markets are briefly reviewed.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper draws a parallel between thermodynamic laws and economic principles, applying phase transition and renormalization theory to understand and predict trend changes in stock markets.

Key Results

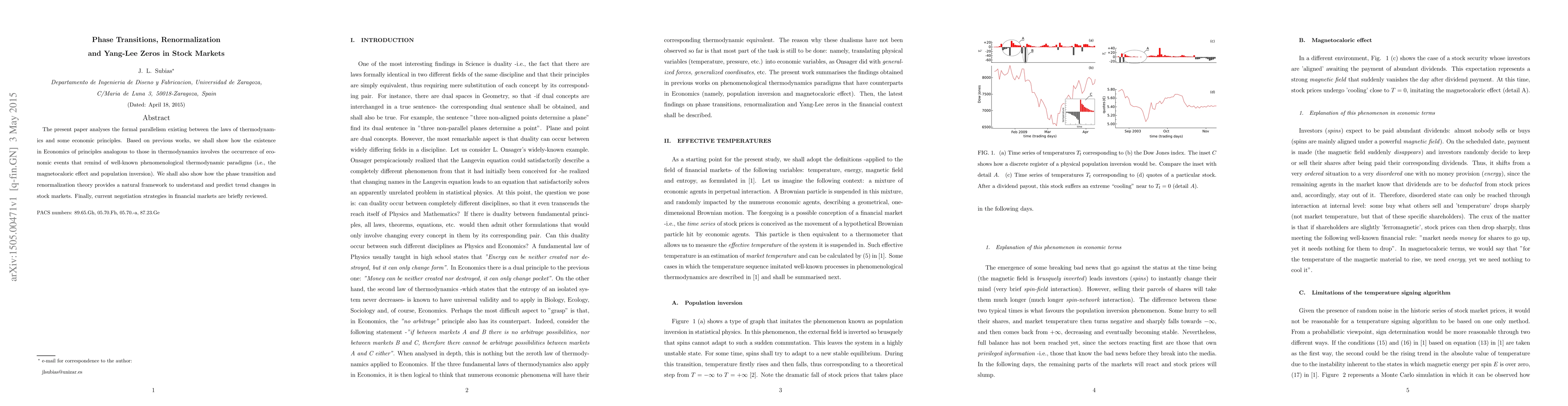

- The paper identifies economic events analogous to thermodynamic paradigms, such as magnetocaloric effect and population inversion, in stock market behavior.

- Stock market trend changes are likened to phase transitions, suggesting a framework for predicting market trends using renormalization theory.

- The paper discusses the impact of breaking news on stock market 'temperature' and subsequent 'cooling' periods post-dividend payouts.

Significance

This research is significant as it attempts to apply established physical theories to economic phenomena, potentially offering new predictive models for stock market trends.

Technical Contribution

The paper proposes a novel application of renormalization theory and Yang-Lee zeros to stock market analysis, suggesting a method for identifying phase transitions in market trends.

Novelty

This work stands out by bridging the gap between statistical physics and economics, offering a fresh perspective on stock market dynamics through the lens of thermodynamic principles.

Limitations

- The presence of random noise in historical stock market price series may limit the effectiveness of a temperature signing algorithm based on a single method.

- The study's Monte Carlo simulations indicate that for strong ferromagnetism levels, the criterion for determining temperature sign may no longer be valid.

Future Work

- Further investigation into refining temperature signing algorithms to account for noise in stock market data.

- Exploration of additional economic indicators and their potential integration into the renormalization framework.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFidelity zeros and Lee-Yang theory of quantum phase transitions

Gaoyong Sun, Tian-Yi Gu

No citations found for this paper.

Comments (0)