Summary

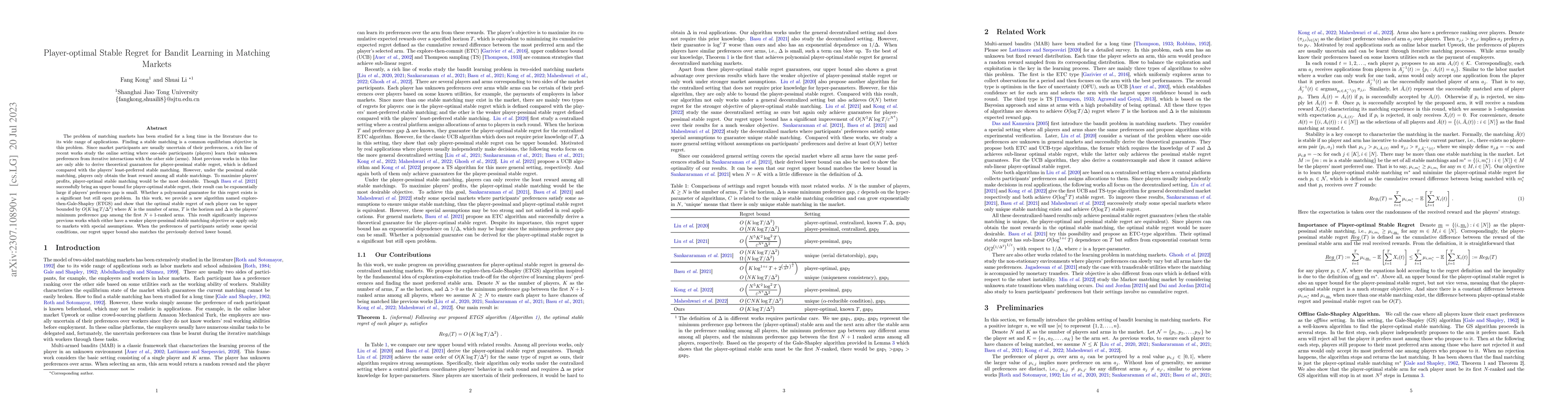

The problem of matching markets has been studied for a long time in the literature due to its wide range of applications. Finding a stable matching is a common equilibrium objective in this problem. Since market participants are usually uncertain of their preferences, a rich line of recent works study the online setting where one-side participants (players) learn their unknown preferences from iterative interactions with the other side (arms). Most previous works in this line are only able to derive theoretical guarantees for player-pessimal stable regret, which is defined compared with the players' least-preferred stable matching. However, under the pessimal stable matching, players only obtain the least reward among all stable matchings. To maximize players' profits, player-optimal stable matching would be the most desirable. Though \citet{basu21beyond} successfully bring an upper bound for player-optimal stable regret, their result can be exponentially large if players' preference gap is small. Whether a polynomial guarantee for this regret exists is a significant but still open problem. In this work, we provide a new algorithm named explore-then-Gale-Shapley (ETGS) and show that the optimal stable regret of each player can be upper bounded by $O(K\log T/\Delta^2)$ where $K$ is the number of arms, $T$ is the horizon and $\Delta$ is the players' minimum preference gap among the first $N+1$-ranked arms. This result significantly improves previous works which either have a weaker player-pessimal stable matching objective or apply only to markets with special assumptions. When the preferences of participants satisfy some special conditions, our regret upper bound also matches the previously derived lower bound.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRegret, stability & fairness in matching markets with bandit learners

Devavrat Shah, Sarah H. Cen

Learning Equilibria in Matching Markets from Bandit Feedback

Yixin Wang, Alexander Wei, Jacob Steinhardt et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)