Authors

Summary

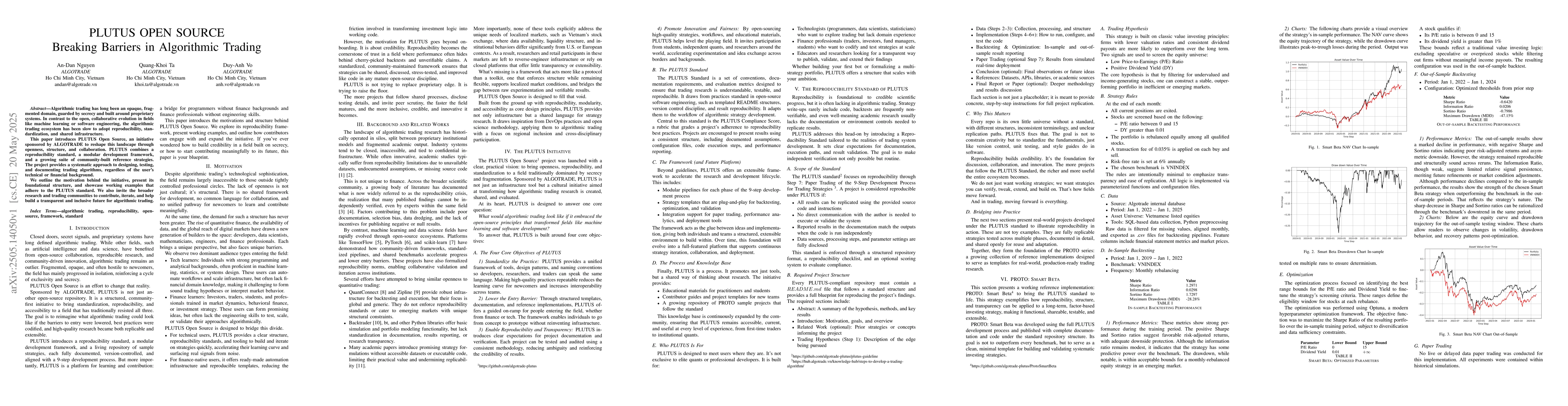

Algorithmic trading has long been an opaque, fragmented domain, guarded by secrecy and built around proprietary systems. In contrast to the open, collaborative evolution in fields like machine learning or software engineering, the algorithmic trading ecosystem has been slow to adopt reproducibility, standardization, and shared infrastructure. This paper introduces PLUTUS Open Source, an initiative sponsored by ALGOTRADE to reshape this landscape through openness, structure, and collaboration. PLUTUS combines a reproducibility standard, a modular development framework, and a growing suite of community-built reference strategies. The project provides a systematic approach to designing, testing, and documenting trading algorithms, regardless of the user's technical or financial background. We outline the motivation behind the initiative, present its foundational structure, and showcase working examples that adhere to the PLUTUS standard. We also invite the broader research and trading communities to contribute, iterate, and help build a transparent and inclusive future for algorithmic trading.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper outlines PLUTUS Open Source, an initiative introducing a reproducibility standard, a modular development framework, and community-built reference strategies for algorithmic trading.

Key Results

- PLUTUS provides a systematic approach for designing, testing, and documenting trading algorithms.

- The initiative aims to make algorithmic trading more transparent and inclusive.

Significance

This research is important as it seeks to reshape the opaque and fragmented algorithmic trading domain by promoting openness, structure, and collaboration, which contrasts with the proprietary systems currently in use.

Technical Contribution

The main technical contribution is the PLUTUS Open Source initiative, which includes a reproducibility standard, a modular development framework, and a suite of community-built reference strategies.

Novelty

PLUTUS distinguishes itself by advocating for openness, standardization, and shared infrastructure in algorithmic trading, unlike existing proprietary systems.

Limitations

- The paper does not detail specific limitations of the PLUTUS approach.

- Potential challenges in community adoption and contribution are not discussed.

Future Work

- The authors invite the research and trading communities to contribute to PLUTUS.

- Further development and refinement of the PLUTUS framework are suggested.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)