Summary

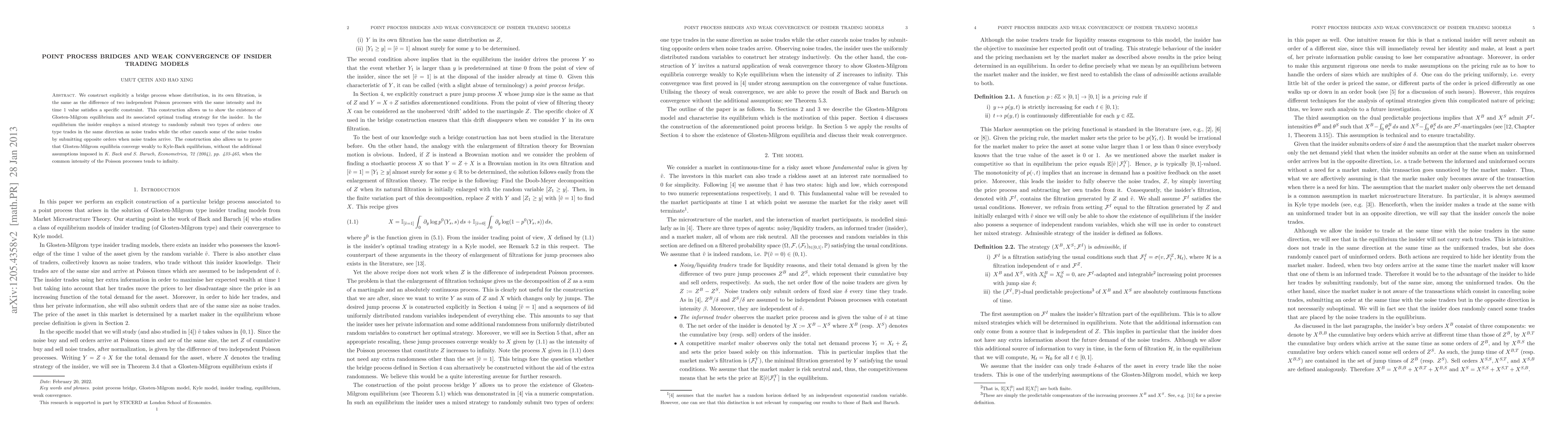

We construct explicitly a bridge process whose distribution, in its own filtration, is the same as the difference of two independent Poisson processes with the same intensity and its time 1 value satisfies a specific constraint. This construction allows us to show the existence of Glosten-Milgrom equilibrium and its associated optimal trading strategy for the insider. In the equilibrium the insider employs a mixed strategy to randomly submit two types of orders: one type trades in the same direction as noise trades while the other cancels some of the noise trades by submitting opposite orders when noise trades arrive. The construction also allows us to prove that Glosten-Milgrom equilibria converge weakly to Kyle-Back equilibrium, without the additional assumptions imposed in \textit{K. Back and S. Baruch, Econometrica, 72 (2004), pp. 433-465}, when the common intensity of the Poisson processes tends to infinity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the weak convergence of conditioned Bessel bridges

Kensuke Ishitani, Tokufuku Rin, Shun Yanashima

| Title | Authors | Year | Actions |

|---|

Comments (0)