Authors

Summary

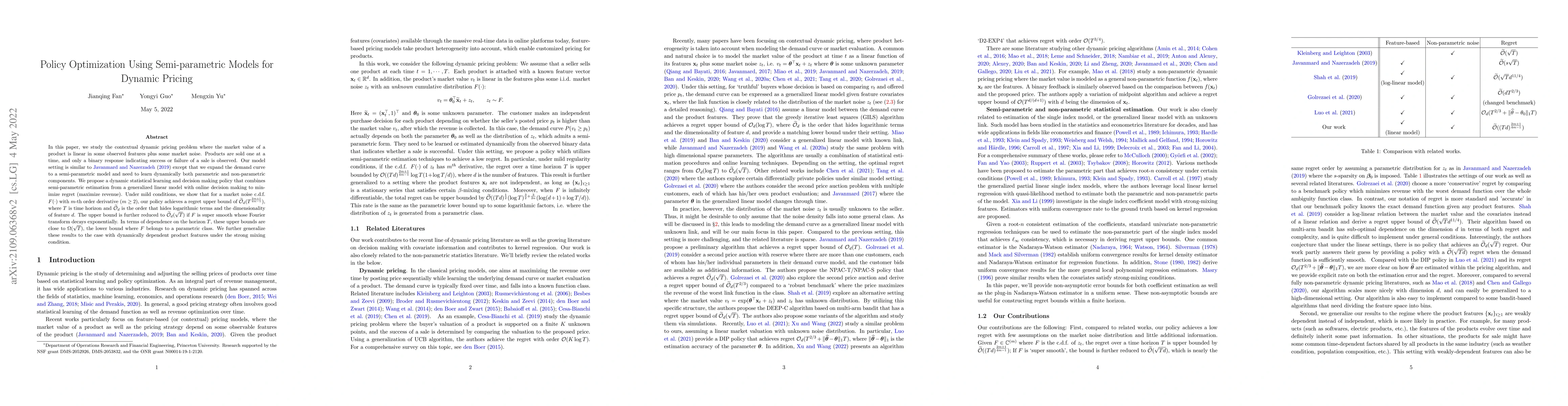

In this paper, we study the contextual dynamic pricing problem where the market value of a product is linear in its observed features plus some market noise. Products are sold one at a time, and only a binary response indicating success or failure of a sale is observed. Our model setting is similar to Javanmard and Nazerzadeh [2019] except that we expand the demand curve to a semiparametric model and need to learn dynamically both parametric and nonparametric components. We propose a dynamic statistical learning and decision-making policy that combines semiparametric estimation from a generalized linear model with an unknown link and online decision-making to minimize regret (maximize revenue). Under mild conditions, we show that for a market noise c.d.f. $F(\cdot)$ with $m$-th order derivative ($m\geq 2$), our policy achieves a regret upper bound of $\tilde{O}_{d}(T^{\frac{2m+1}{4m-1}})$, where $T$ is time horizon and $\tilde{O}_{d}$ is the order that hides logarithmic terms and the dimensionality of feature $d$. The upper bound is further reduced to $\tilde{O}_{d}(\sqrt{T})$ if $F$ is super smooth whose Fourier transform decays exponentially. In terms of dependence on the horizon $T$, these upper bounds are close to $\Omega(\sqrt{T})$, the lower bound where $F$ belongs to a parametric class. We further generalize these results to the case with dynamically dependent product features under the strong mixing condition.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Contextual Pricing with Doubly Non-Parametric Random Utility Models

Xi Chen, Elynn Chen, Lan Gao et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)