Summary

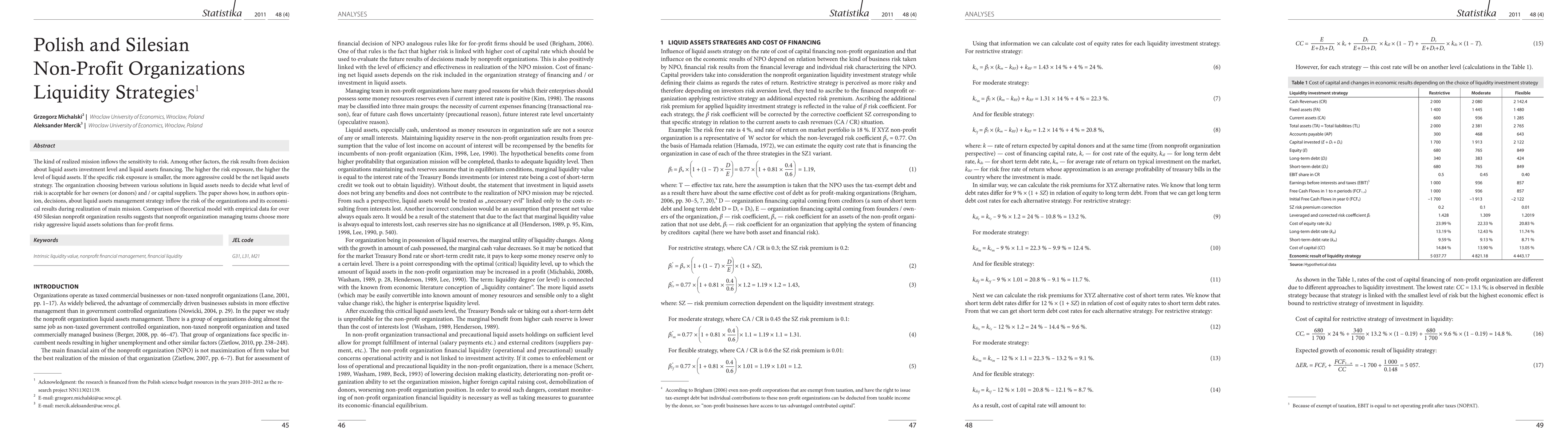

The kind of realized mission inflows the sensitivity to risk. Among other factors, the risk results from decision about liquid assets investment level and liquid assets financing. The higher the risk exposure, the higher the level of liquid assets. If the specific risk exposure is smaller, the more aggressive could be the net liquid assets strategy. The organization choosing between various solutions in liquid assets needs to decide what level of risk is acceptable for her owners (or donors) and / or capital suppliers. The paper shows how, in authors opinion, decisions, about liquid assets management strategy inflow the risk of the organizations and its economical results during realization of main mission. Comparison of theoretical model with empirical data for over 450 Silesian nonprofit organization results suggests that nonprofit organization managing teams choose more risky aggressive liquid assets solutions than for-profit firms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutomated Market Makers: Toward More Profitable Liquidity Provisioning Strategies

Ali Sunyaev, Niclas Kannengießer, Daniel Kirste et al.

Liquidity provision with $τ$-reset strategies: a dynamic historical liquidity approach

Andrey Urusov, Rostislav Berezovskiy, Anatoly Krestenko et al.

AI-Enabled Knowledge Sharing for Enhanced Collaboration and Decision-Making in Non-Profit Healthcare Organizations: A Scoping Review Protocol

Maurice Ongala, Ruth Kiraka, Jyoti Choundrie et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)