Authors

Summary

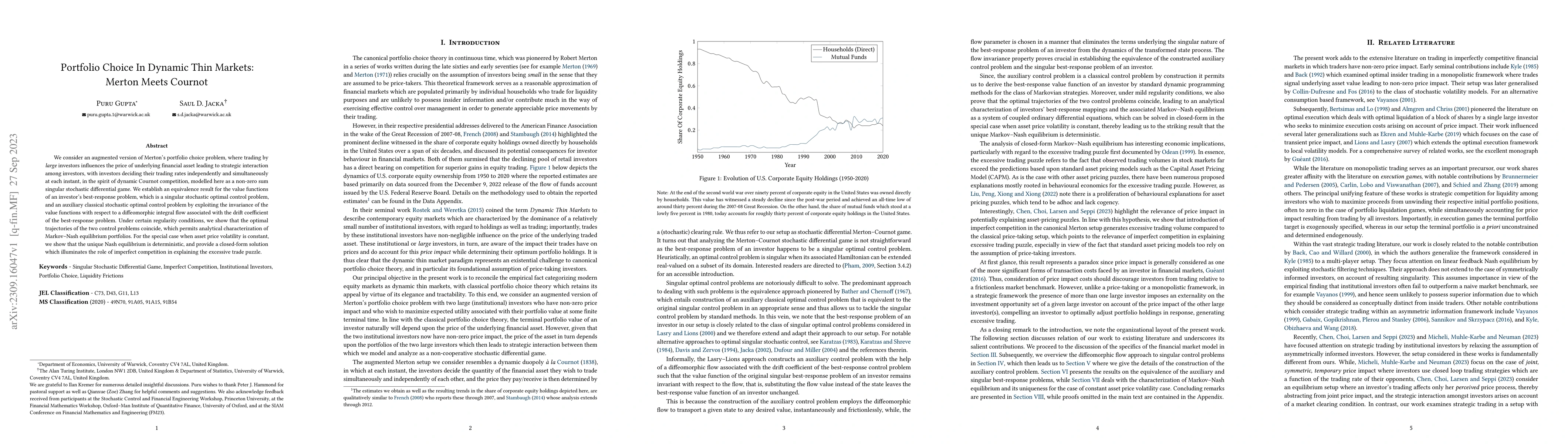

We consider an augmented version of Merton's portfolio choice problem, where trading by large investors influences the price of underlying financial asset leading to strategic interaction among investors, with investors deciding their trading rates independently and simultaneously at each instant, in the spirit of dynamic Cournot competition, modelled here as a non-zero sum singular stochastic differential game. We establish an equivalence result for the value functions of an investor's best-response problem, which is a singular stochastic optimal control problem, and an auxiliary classical stochastic optimal control problem by exploiting the invariance of the value functions with respect to a diffeomorphic integral flow associated with the drift coefficient of the best-response problem. Under certain regularity conditions, we show that the optimal trajectories of the two control problems coincide, which permits analytical characterization of Markov-Nash equilibrium portfolios. For the special case when asset price volatility is constant, we show that the unique Nash equilibrium is deterministic, and provide a closed-form solution which illuminates the role of imperfect competition in explaining the excessive trade puzzle.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImproved Deep Learning Methods for Large-Scale Dynamic Portfolio Choice

Jeonggyu Huh, Hyeng Keun Koo, Jaegi Jeon

Dynamic growth-optimum portfolio choice under risk control

Zuo Quan Xu, Pengyu Wei

No citations found for this paper.

Comments (0)