Summary

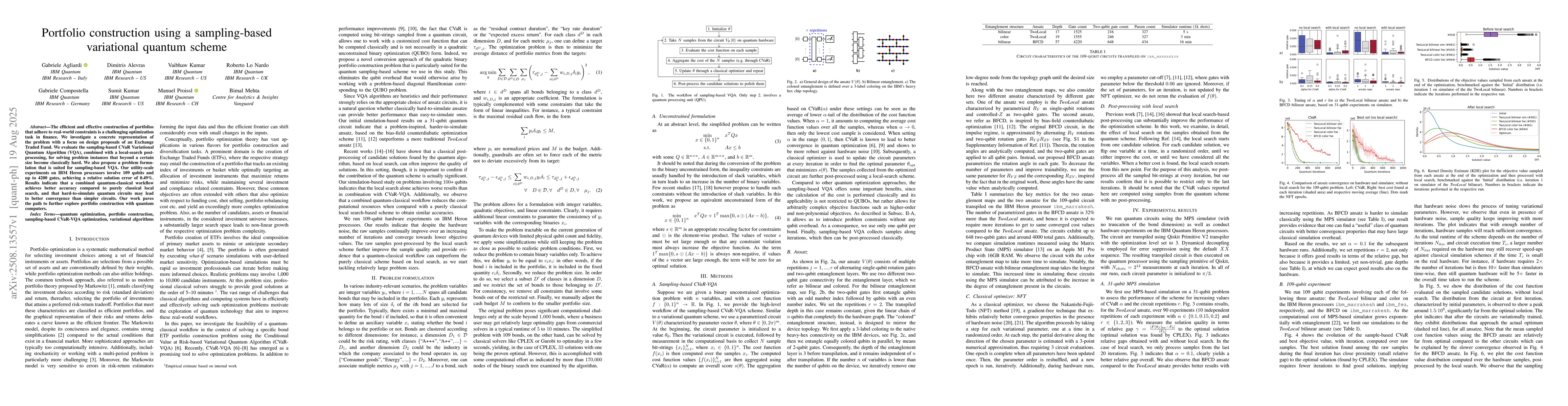

The efficient and effective construction of portfolios that adhere to real-world constraints is a challenging optimization task in finance. We investigate a concrete representation of the problem with a focus on design proposals of an Exchange Traded Fund. We evaluate the sampling-based CVaR Variational Quantum Algorithm (VQA), combined with a local-search post-processing, for solving problem instances that beyond a certain size become classically hard. We also propose a problem formulation that is suited for sampling-based VQA. Our utility-scale experiments on IBM Heron processors involve 109 qubits and up to 4200 gates, achieving a relative solution error of 0.49%. Results indicate that a combined quantum-classical workflow achieves better accuracy compared to purely classical local search, and that hard-to-simulate quantum circuits may lead to better convergence than simpler circuits. Our work paves the path to further explore portfolio construction with quantum computers.

AI Key Findings

Generated Aug 22, 2025

Methodology

The research investigates a sampling-based Variational Quantum Algorithm (VQA) for portfolio construction, focusing on a customized cost function computed classically and a problem formulation suited for quantum sampling. It compares a combined quantum-classical workflow with purely classical local search methods.

Key Results

- A combined quantum-classical workflow achieves better accuracy than purely classical local search.

- Hard-to-simulate quantum circuits show better convergence than simpler circuits.

- Utility-scale experiments on IBM Heron processors with 109 qubits and up to 4200 gates achieved a relative solution error of 0.49%.

Significance

This work paves the way for further exploration of portfolio construction using quantum computers, demonstrating the potential of quantum algorithms to outperform classical methods in handling complex optimization tasks.

Technical Contribution

The paper proposes a novel conversion approach for the quadratic binary portfolio construction problem, particularly suited for quantum sampling-based schemes, which eliminates qubit overhead associated with problem-based diagonal Hamiltonians.

Novelty

The research introduces a customized cost function computed classically and a problem formulation suited for quantum sampling, distinguishing it from previous quantum optimization methods that typically rely on QUBO formulations.

Limitations

- The study was limited to utility-scale experiments on IBM Heron processors with specific hardware constraints.

- The research did not extensively explore the scalability of the proposed method for significantly larger problem instances.

Future Work

- Investigate the scalability of the sampling-based VQA for even larger problem instances.

- Explore the application of this method to other complex optimization problems in finance and related fields.

Paper Details

PDF Preview

Similar Papers

Found 4 papersVariational Bayes Portfolio Construction

Claire Vernade, Nicolas Nguyen, James Ridgway

Scaling the Variational Quantum Eigensolver for Dynamic Portfolio Optimization

Senaida Hernández-Santana, Álvaro Nodar, Irene De León et al.

Comments (0)